Recently, there has been Interesting news about the first attack on the network. Contrary to some researchers, the experts of Bitquery analytics company don’t think that the attack was caused by a random bug. The attack was planned. The attacker took advantage of the vulnerability in the network and performed a double-spend attack worth 800 thousand ETC.

According to Decrypt, the attacker appropriated the sum equivalent to 5 million dollars. Meanwhile, hashing power rented for the attack cost 192 thousand dollars. The net income is impressive.

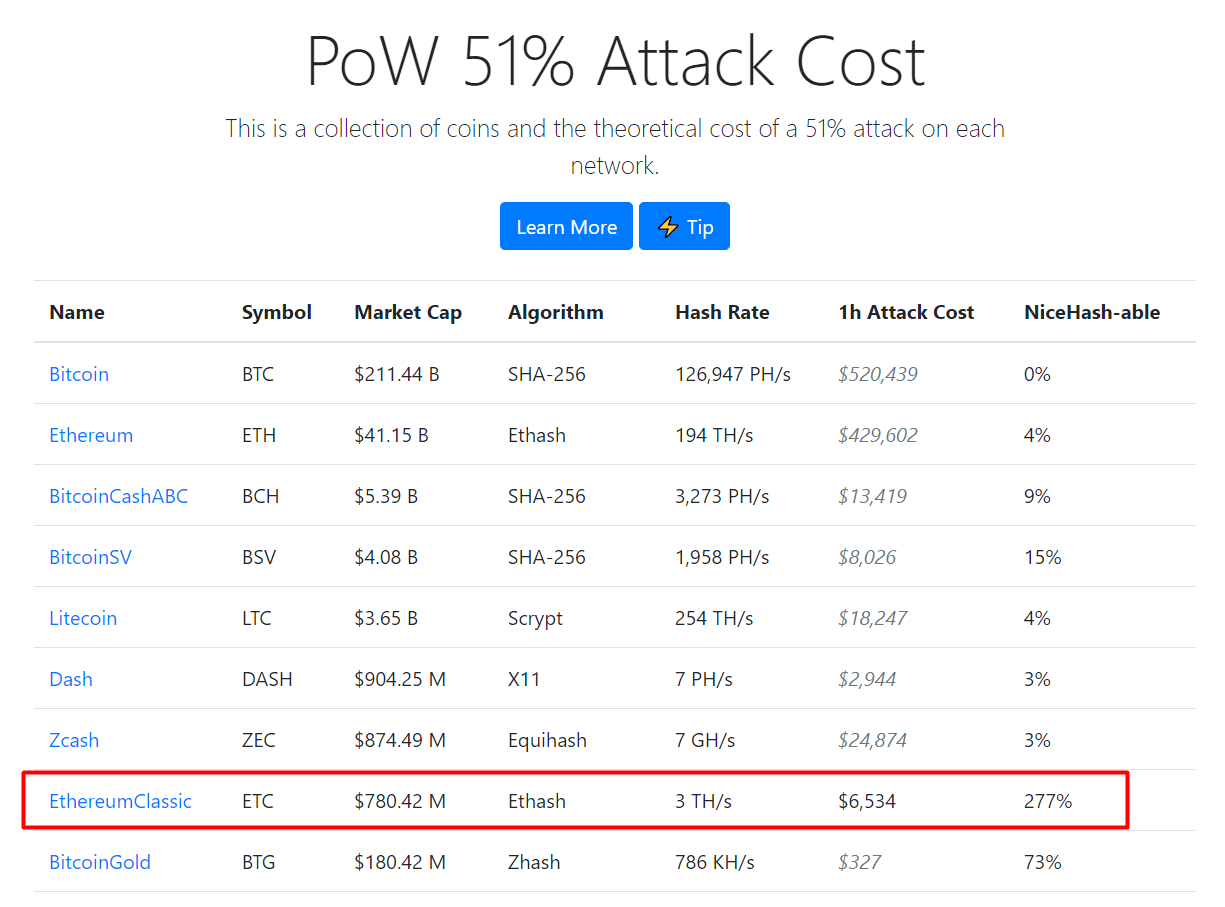

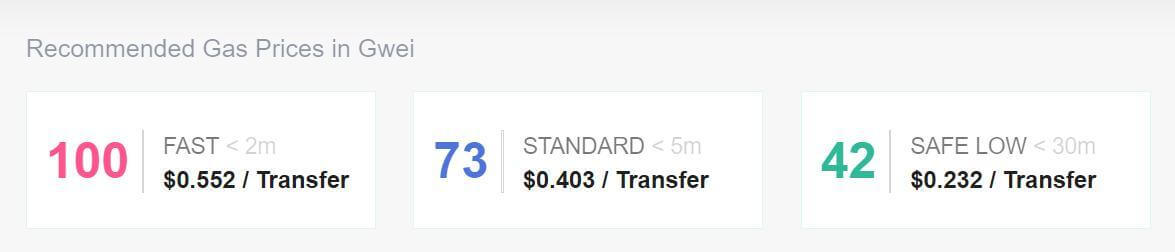

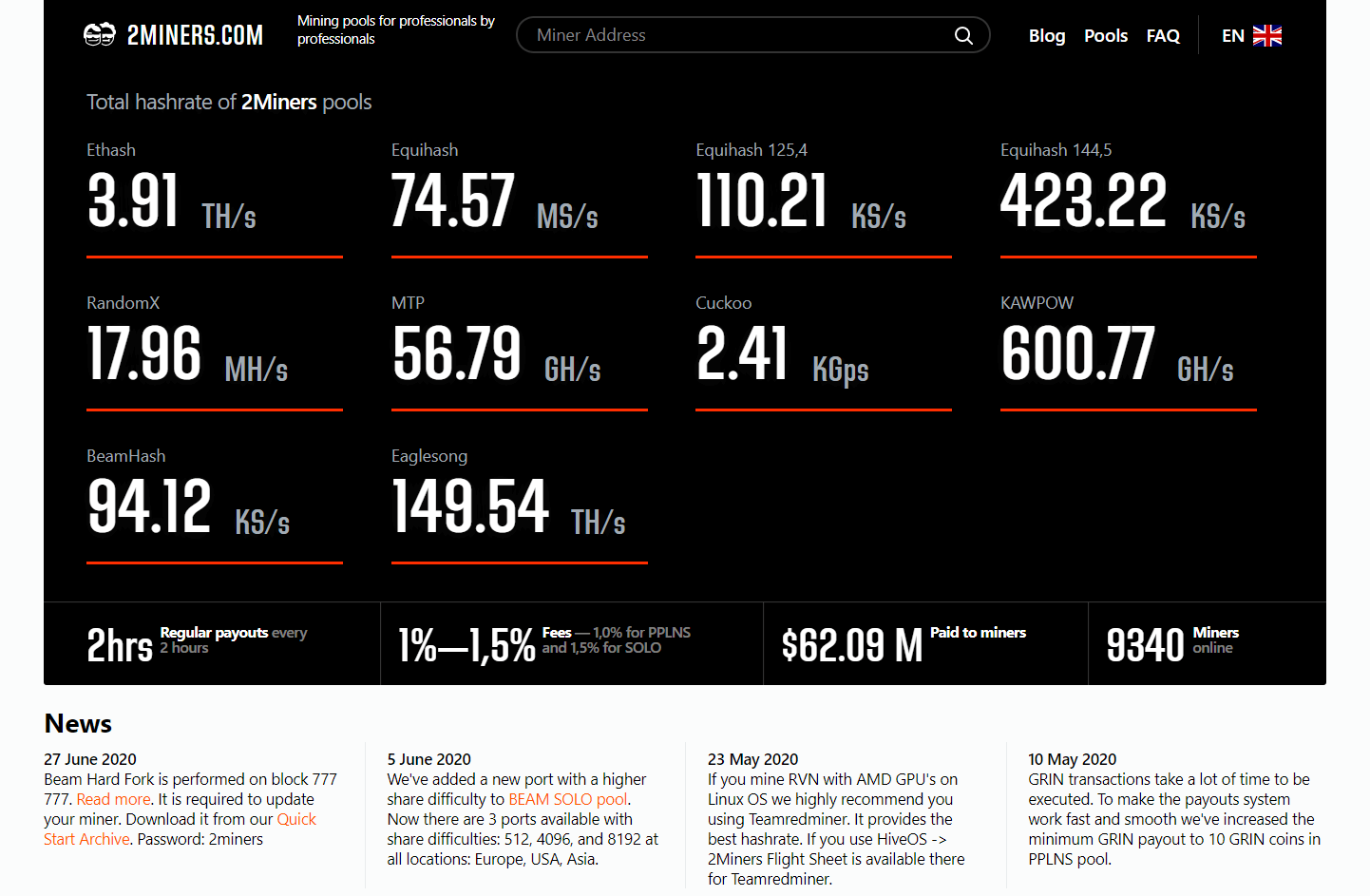

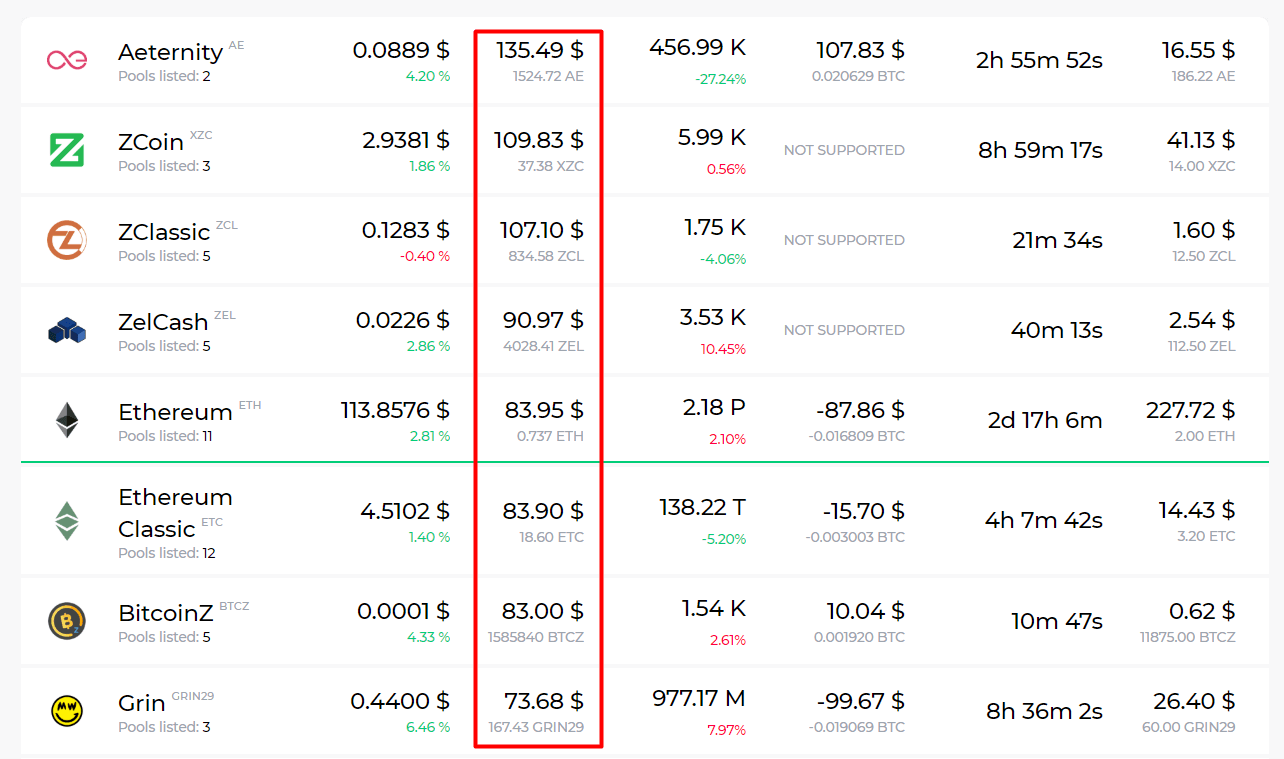

We checked the latest data. According to Crypto51, a 1-hour 51% attack on Ethereum Classic costed 15.73 thousand dollars yesterday and just $6 534 today. For comparison, the same value for Bitcoin and Ethereum is 520 thousand and 429 thousand respectively.

Ethereum Classic under the Second Attack

Yesterday the ETC network has suffered another 51% attack, the second one this week. It is bigger than the first attack. The attacker has turned 4 thousand blocks into orphans.

It is not clear whether it was the same attacker as the first one or someone got “inspired” by Saturday events.

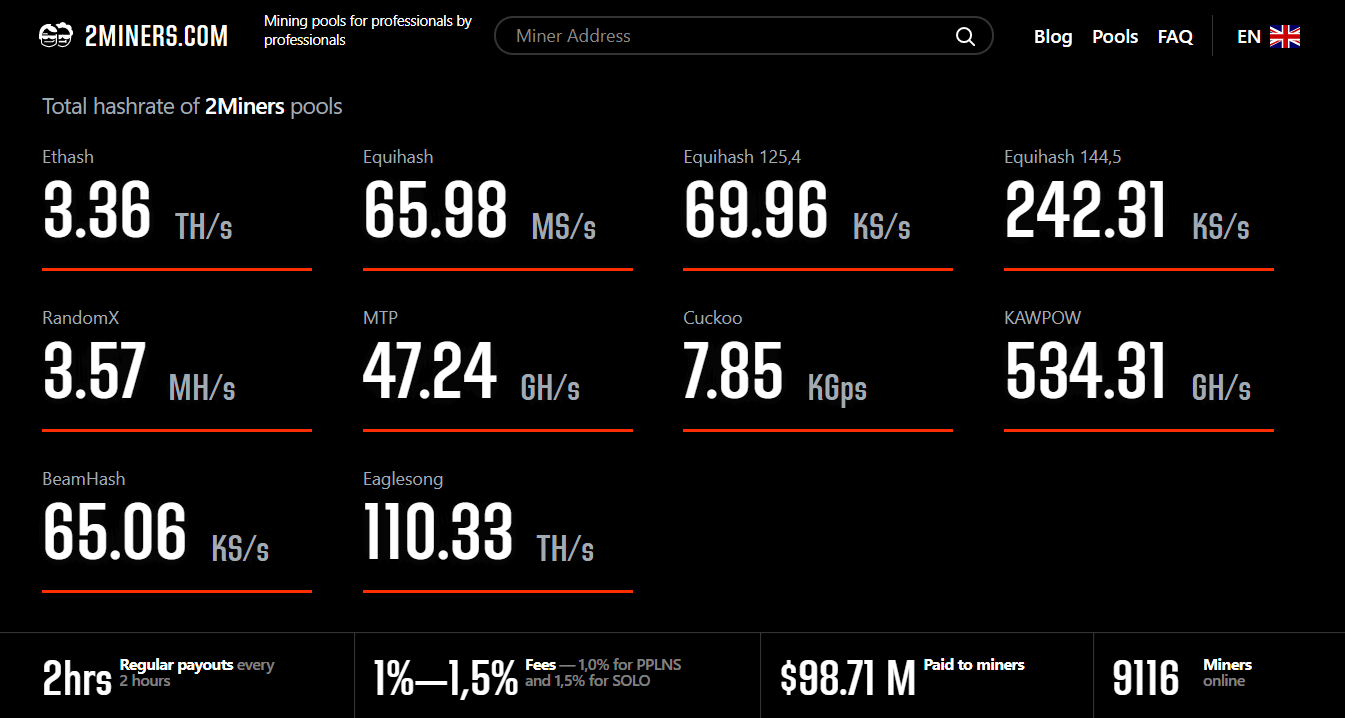

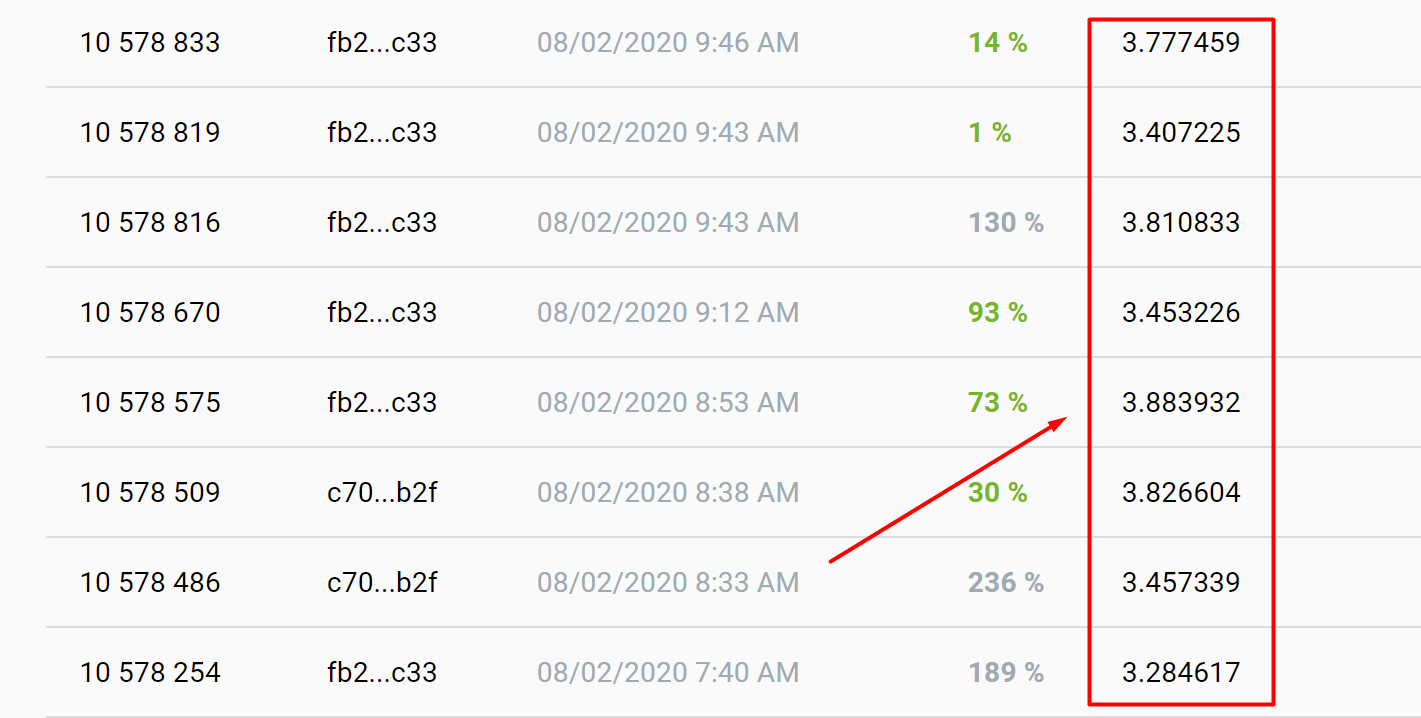

The problems were noticed in the morning. The 2Miners pool interrupted payouts in ETC and recommended miners to switch to Ethereum mining. Reject signs in the right column point to the problems in the network operation.

Another huge attack on Ethereun Classic (ETC) network has been performed recently.

Almost 4000 blocks were rejected after the massive blockchain re-organization.

ETC payouts are stopped. Meanwhile, we recommend you to switch to ETH pool: https://t.co/HtEdjXnA9W pic.twitter.com/7pdVBLPo7a

— 2Miners (@pool2miners) August 6, 2020

Bitfly (Ethermine mining pool) also spoke about the recent events and advised their users to mine Ether.

Today another large 51% attack occurred on the #ETC which caused a reorganization of over 4000 blocks. Until further notice ETC pool payouts are disabled and we encourage all our miners to switch to our #ETH pool at https://t.co/f8Px6gGJiM in the meantime.

— Bitfly (@etherchain_org) August 6, 2020

Vitalik Buterin, an Ethereum co-founder, has joined the discussion. He recommended the ETC developers to switch to Proof-of-Stake. Here is the quote.

ETC should just switch to proof of stake. Even given its risk-averse culture, at this point making the jump seems lower-risk than not making it.

— vitalik.eth (@VitalikButerin) August 6, 2020

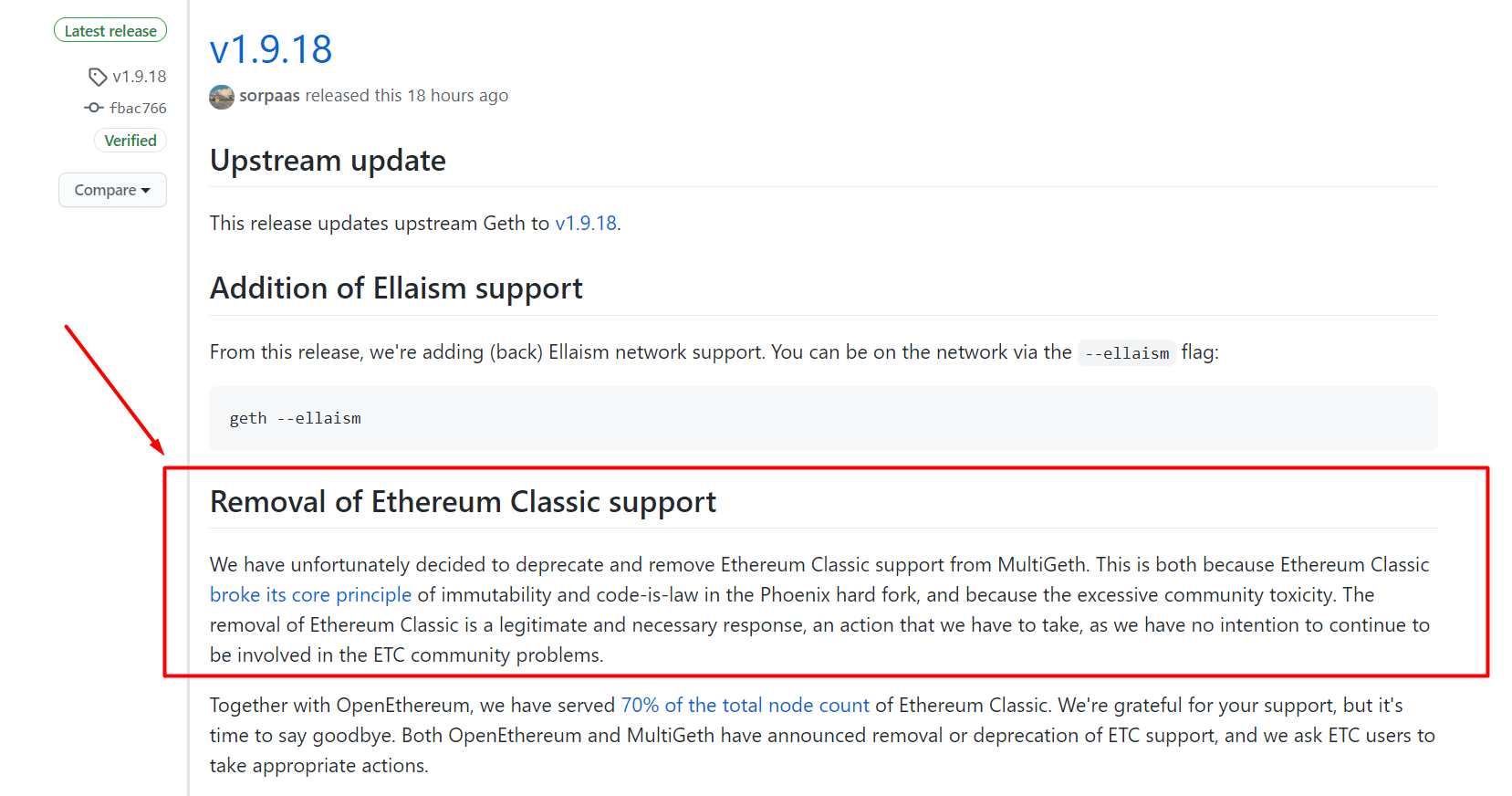

This comment is probably a joke that just draws attention to continuous problems in the ETC network. However, the problems in the ETC network began when the developers removed Ethereum Classic support from the updated version of MultiGeth last week.

Everybody related to Ethereum Classic, especially miners and mining pools, suffered from the attack. For example, Nanopool had to recalculate the balances of ETC accounts, because all the blocks in the interval from 10904147 to 10907763 were rejected. Naturally, miners will not be rewarded for this work.

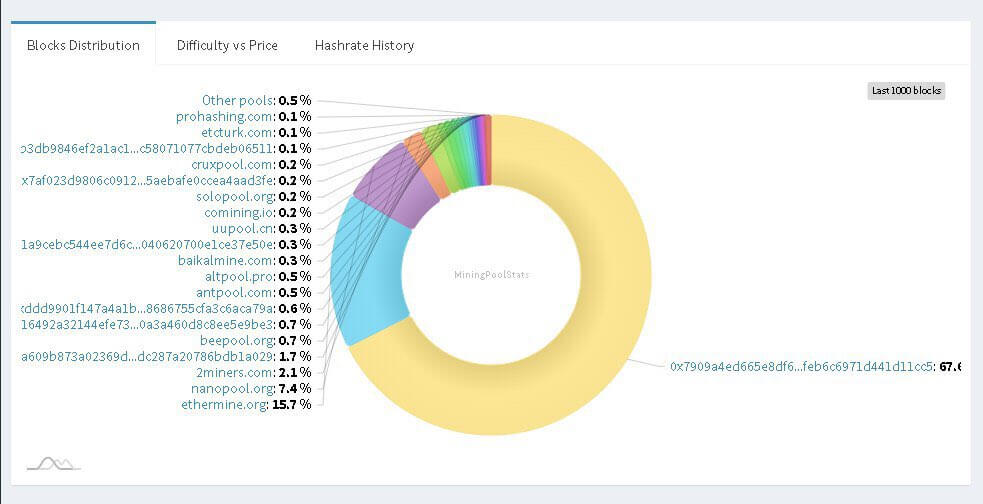

According to MiningPoolStats statistics, the attacker has continued to control the network. At the time of writing, the distribution of the last one thousand blocks looked as follows.

67.9% of the blocks were found by one unknown address.

Ethereum Classic once again recommended pools and exchanges to interrupt payouts.

https://twitter.com/eth_classic/status/1291269777424515076

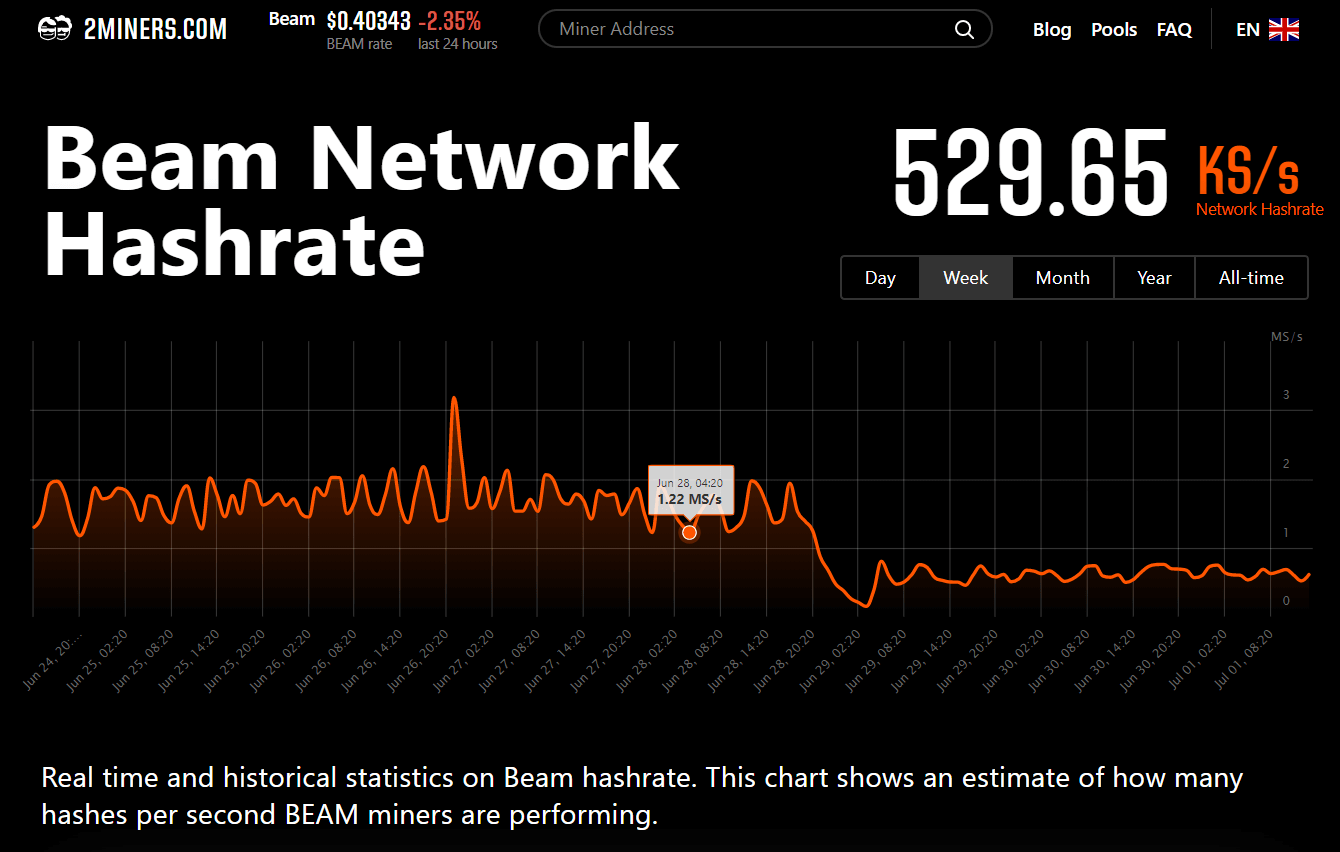

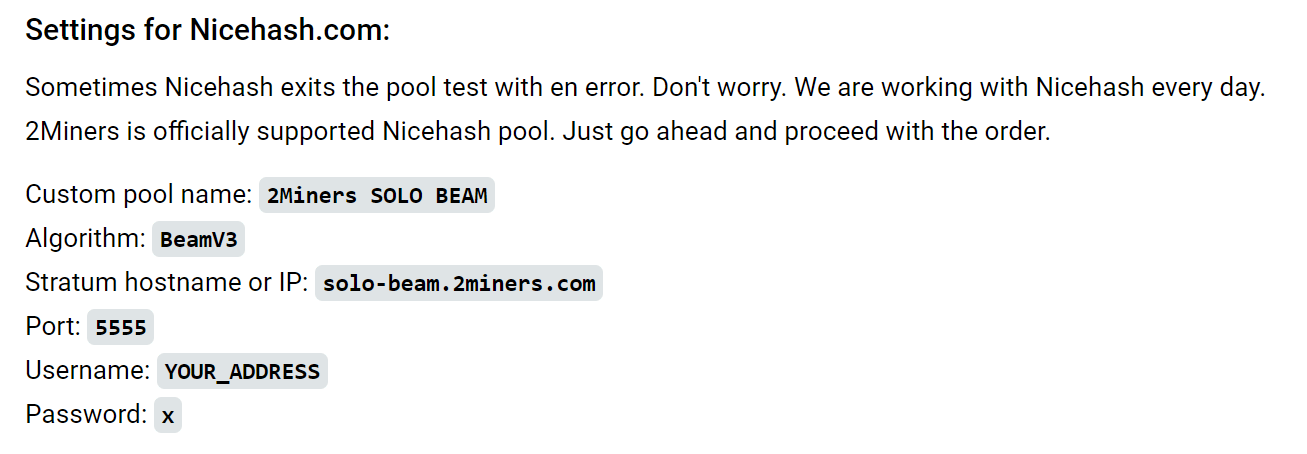

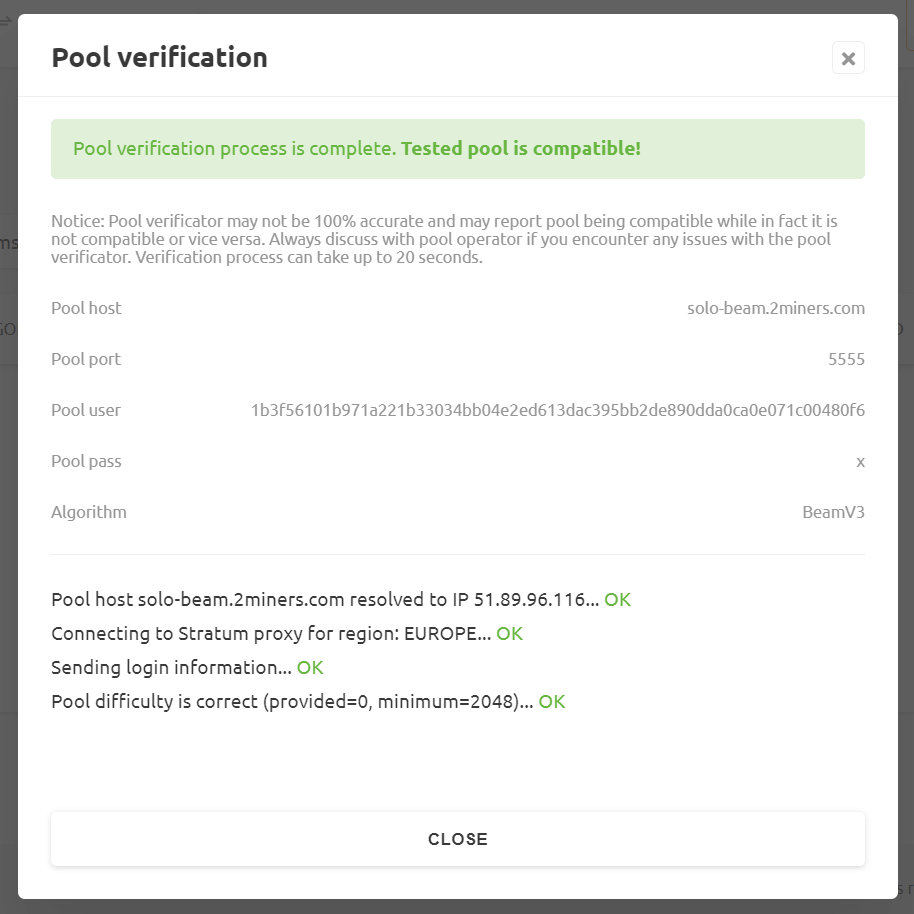

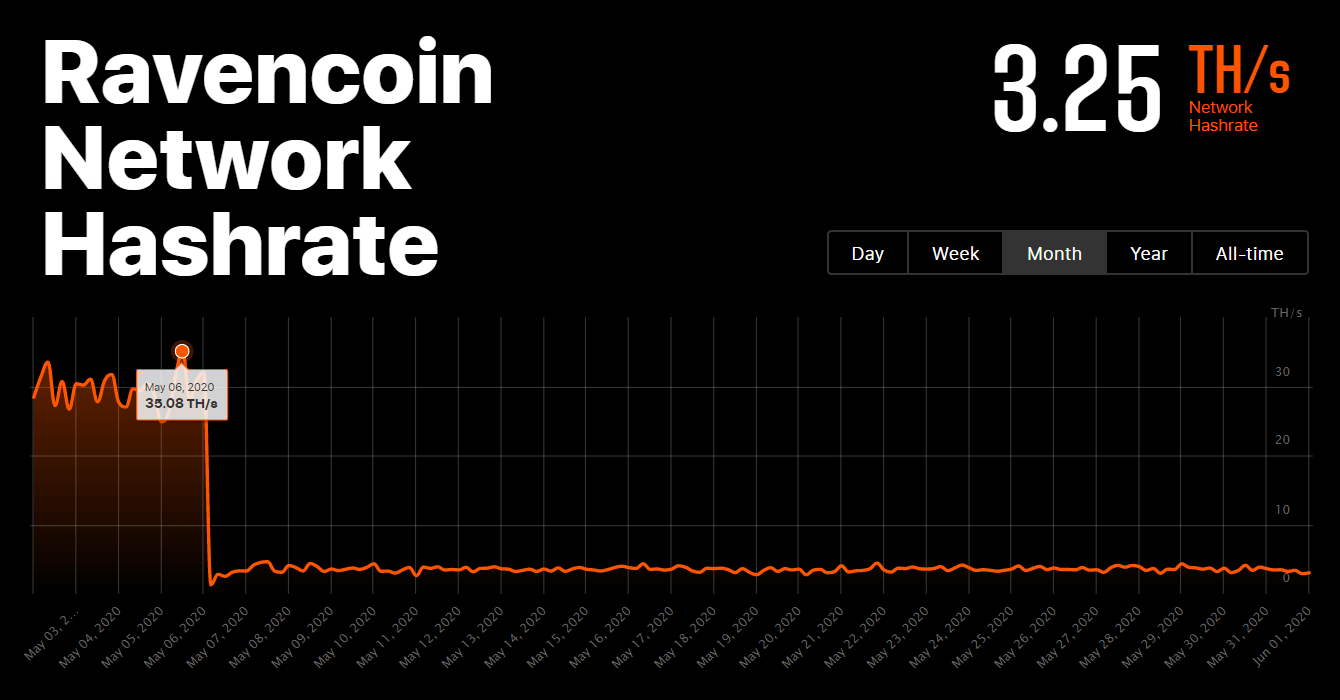

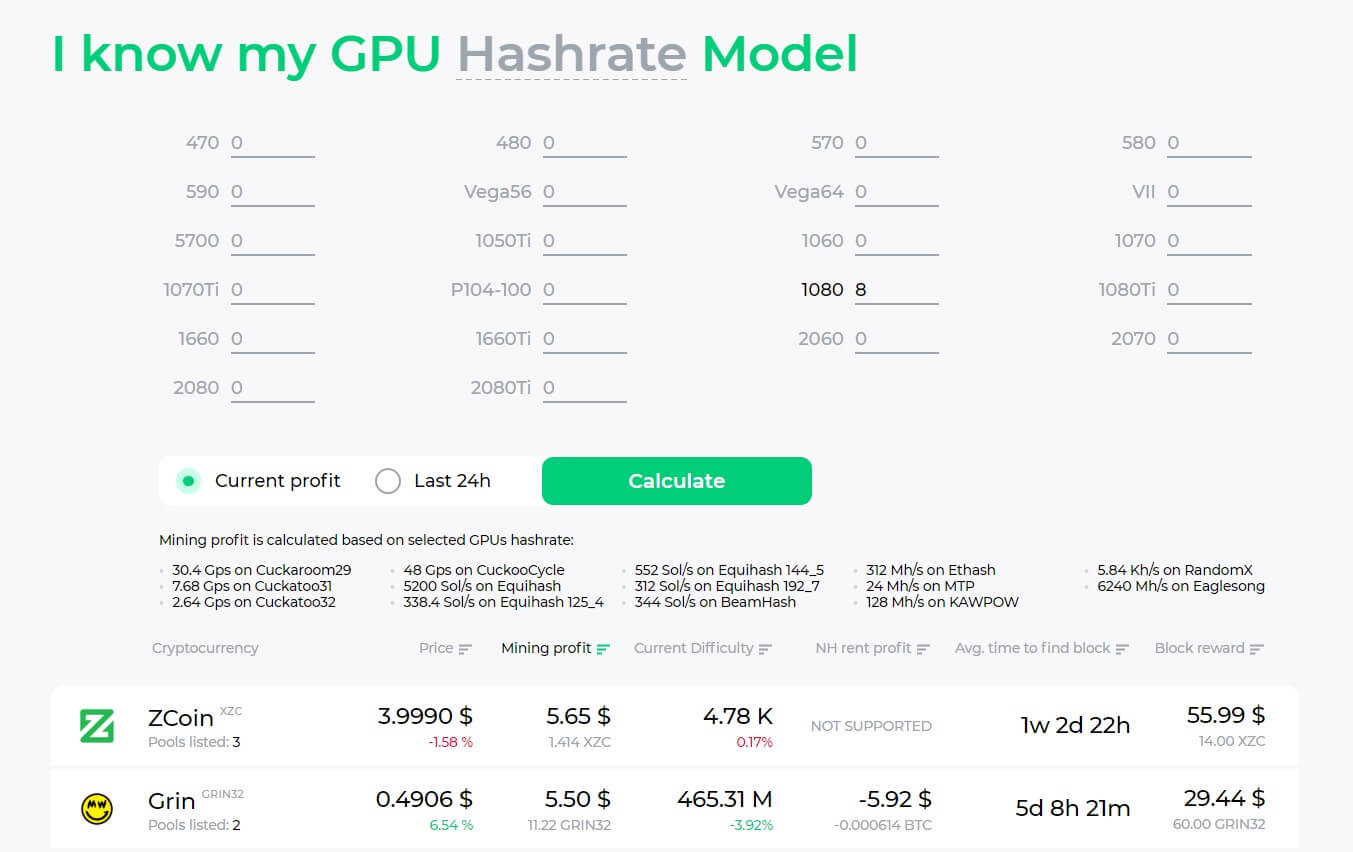

It’s worth reminding that Ethereum Classic is not a dominant coin of the Ethash algorithm. It means that any user can rent hashing power from Nicehash and organize such attacks on the network. Nicehash does have enough power to rent. It possesses 149% of the overall ETC network hash rate, which allows attackers to cause a lot of trouble.

There is no clear solution. The current tendencies may lead to the situation when it would take days for deposits to be approved. For example, they may be approved every 10 000 blocks or more. Considering the current problems, it is impossible to use the network properly.

Until then, there are a lot of risks involved. The second 51% attack started right after the deposits on exchanges had been restored. It means that attackers were waiting for this moment to immediately start the attack.

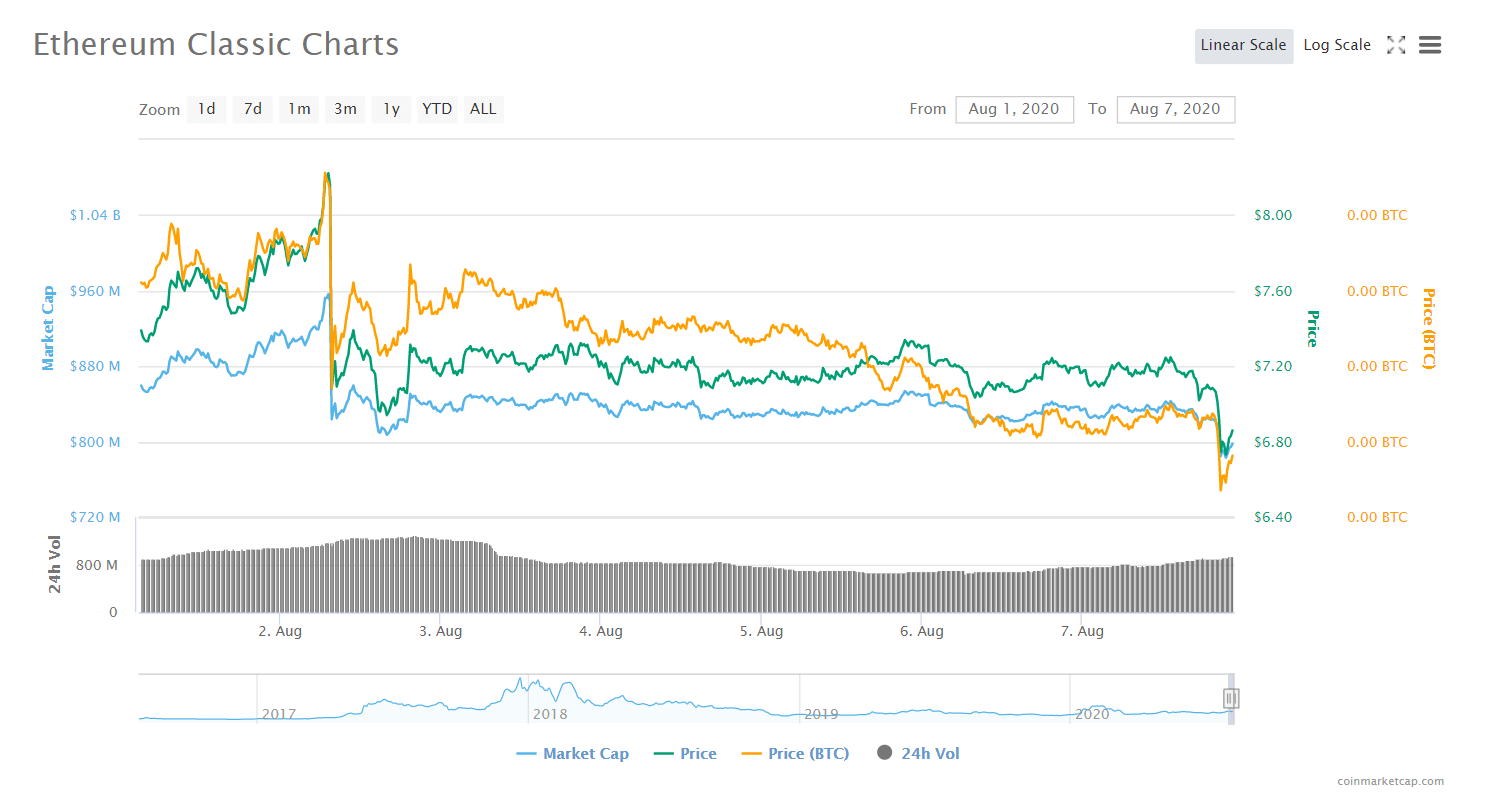

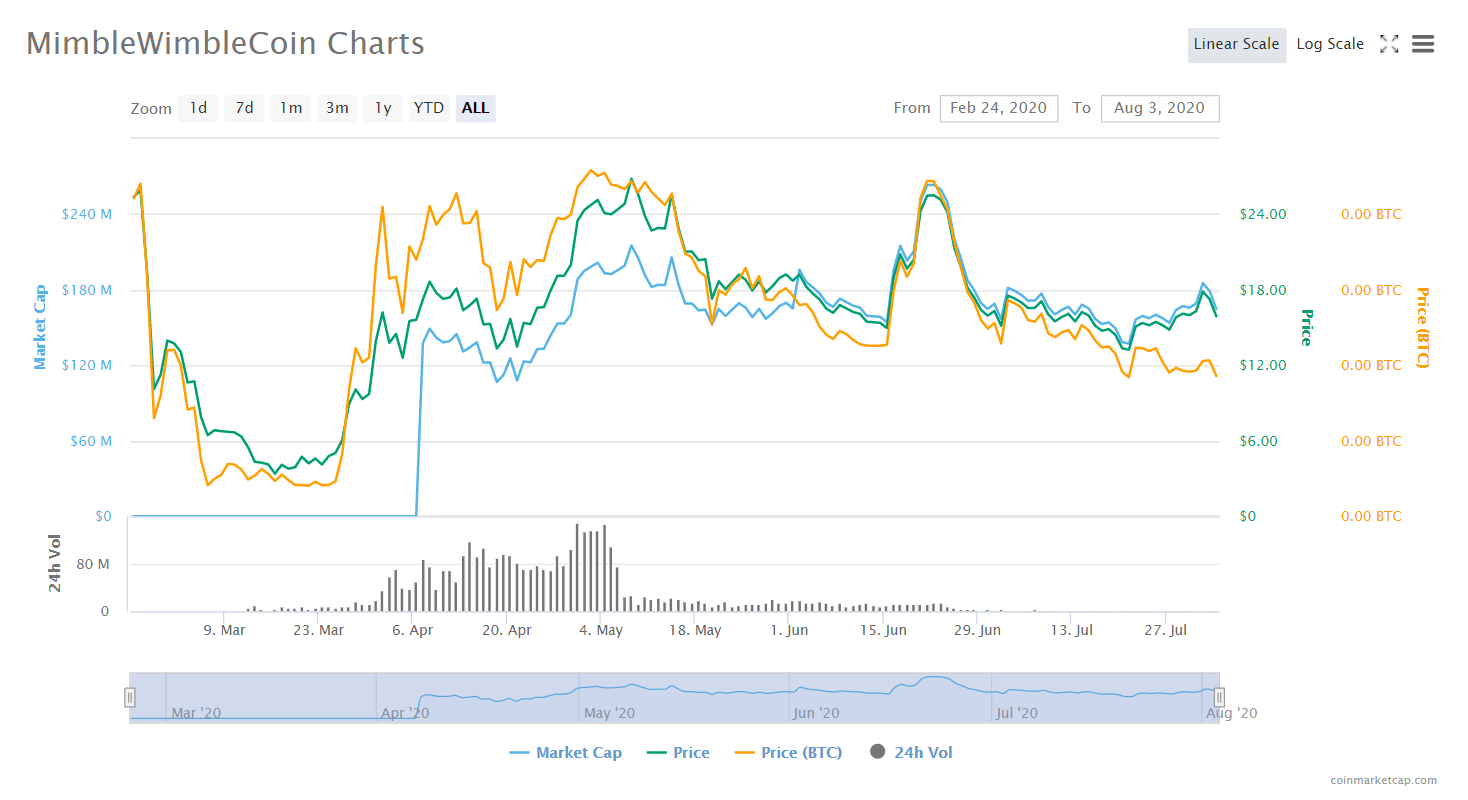

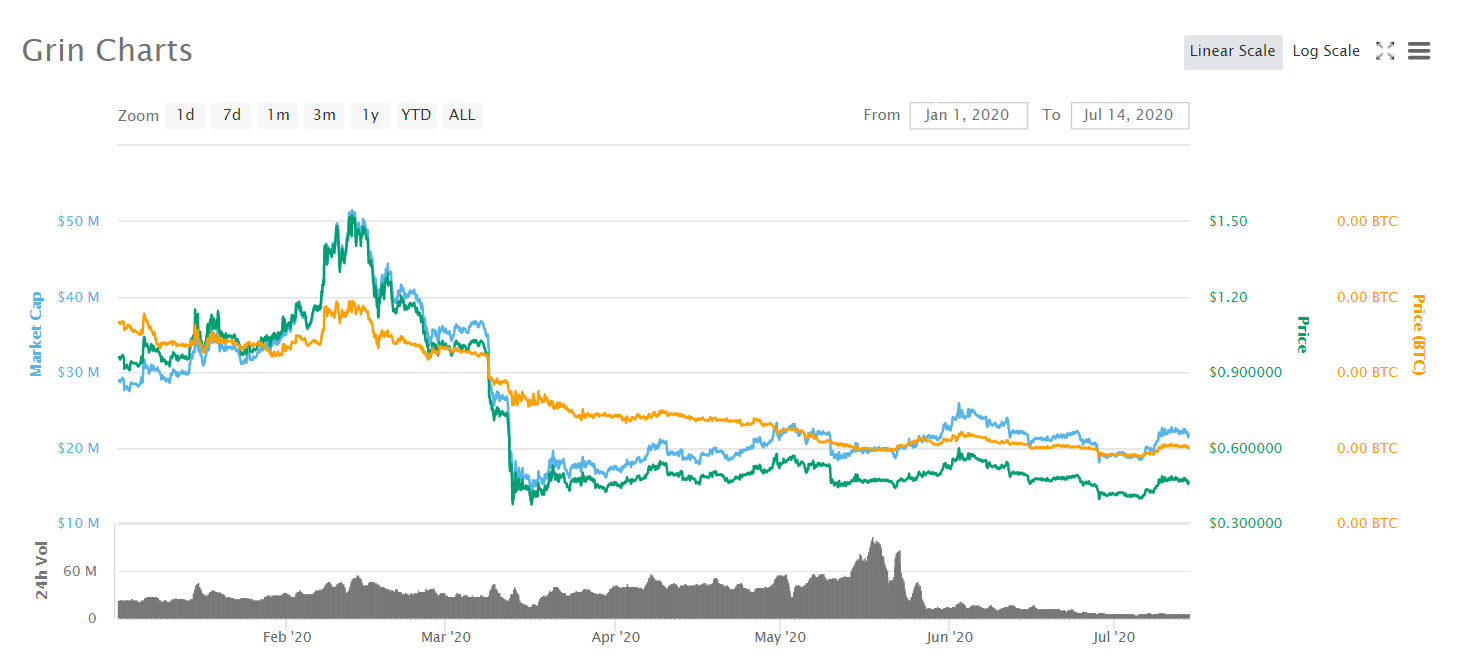

Here is the Ethereum Classic exchange rate chart. We did notice a small reaction to the latest events (but not significant though). The decrease of the ETC cost in the middle of the week, on August 2, coincided with the decline of Bitcoin and the cryptocurrency market in general. So it seems that the first 51% attack has nothing to do with it.

Overall, the situation is sad. The Ethereum Classic network already suffered 51% attacks in the past, but two large-scale reorganizations of thousands of blocks in just five days is too much. Miners can’t ensure the network operation and can’t be certain that they will get the reward. Any time an attacker can rent hashing power, block the ETC operation and deprive you of what you earned during multiple hours of work.

Apparently, the developers didn’t learn their lesson after the first incident failing to find a way to protect the network from the attack. For now, they only ask pools and exchanges to interrupt payouts and share articles about the attacks. Indeed, it is more secure to mine the regular Ethereum nowadays. At least in the nearest future.

If you want to get the latest updates follow us on TWITTER or join our Telegram Chat.