این مقاله از بلاگ توسط عضو جامعه ماینرهای

2Miners آقای سپهر هاشمی به زبان شیرین پارسی ترجمه شده است.

پایان استخراج اتریوم چه تاریخی است؟

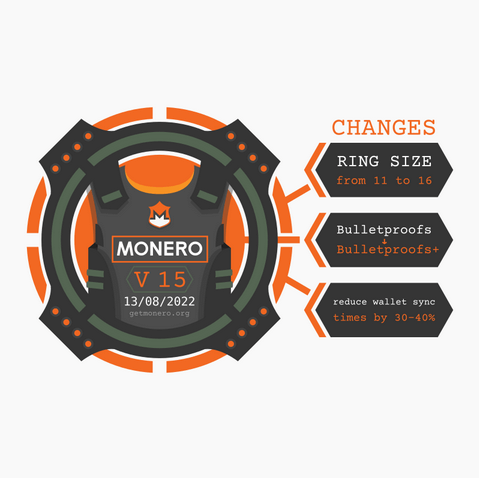

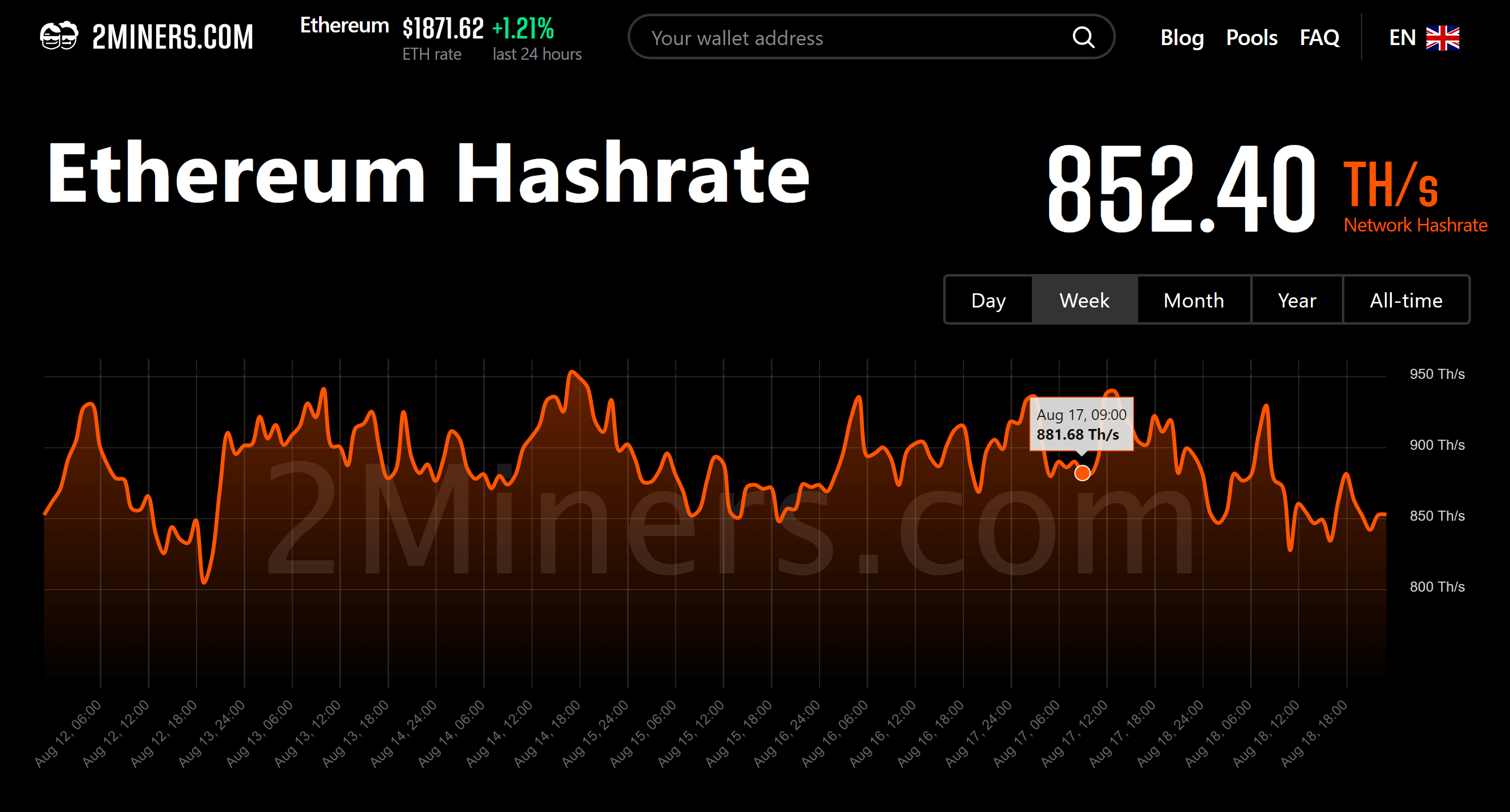

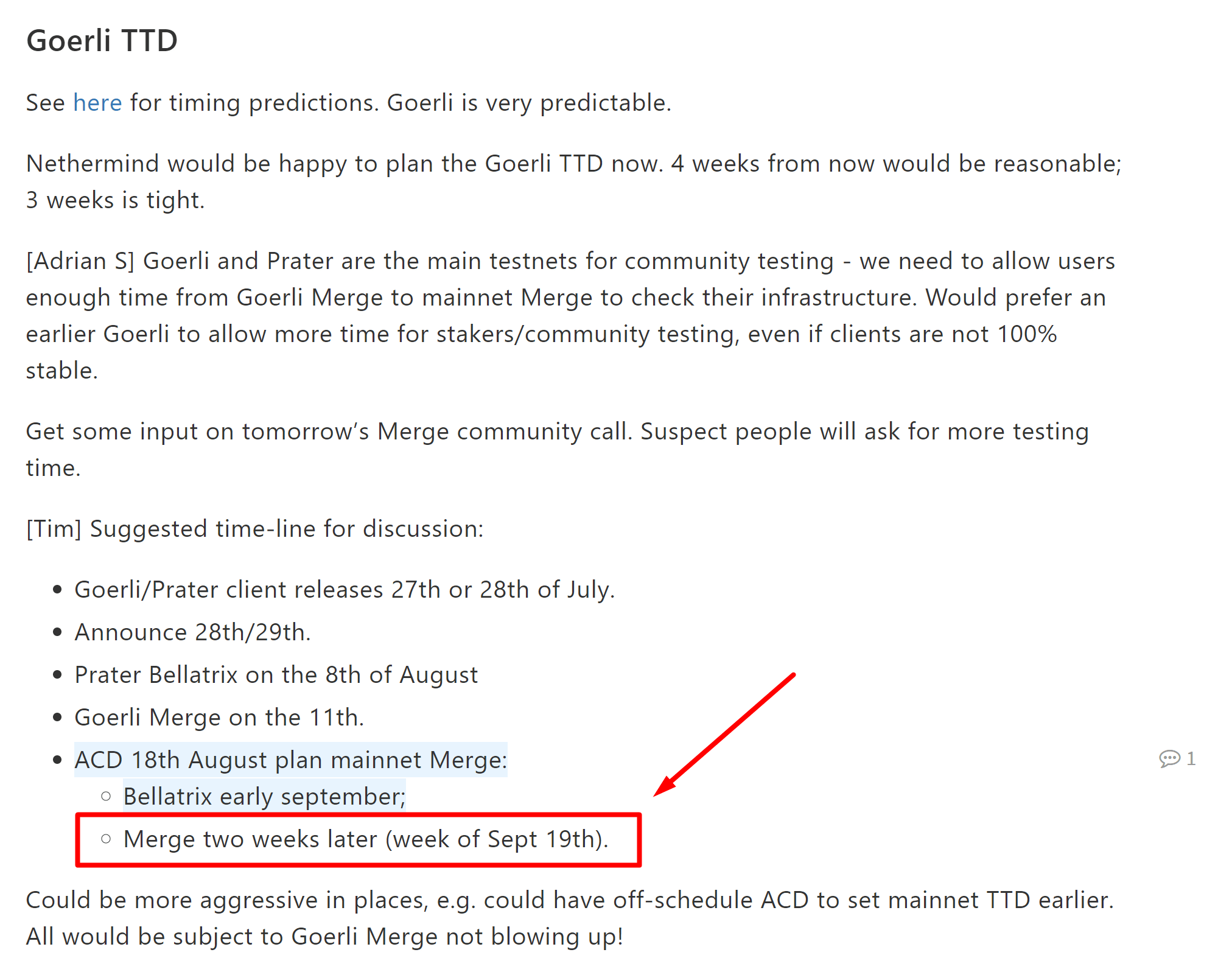

توسعه دهندگان اتریوم شرایط تغییر اجماع از اثبات کار به اثبات سهام را تشریح کردهاند. آنها با پارامتری که به عنوان TTD یا سختی کلی ترمینال شبکه اتریوم شناخته میشود، کار میکنند. محاسبه سختی کلی ترمینال کار بسیار پیچیدهای است. به عبارت ساده، این پارامتر، یک شمارنده معکوس (یک متغییر در برنامه نویسی) هست که با هر بلوک جدیدی که در شبکه اتریوم یافت میشود، رشد میکند

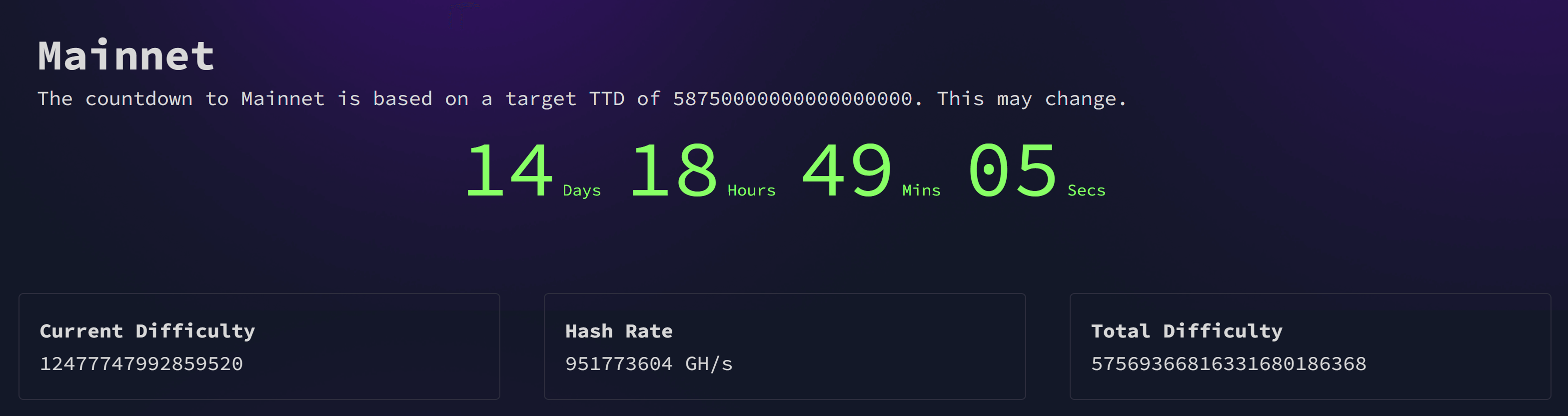

وبسایت Wen Merge? یک وبسایت جالب دارای شمارش معکوس برای مرج است. شما میتوانید میزان سختی کلی ترمینال را در این وبسایت بررسی کنید

میزان سختی کلی ترمینال در زمان نگارش متن اصلی مقاله یعنی سیام آگوست به میزان 57,569,366,816,331,680,186,368 بوده است و زمانی که این پارامتر به عدد 58,750,000,000,000,000,000,000 در حوالی تاریخ چهاردهم سپتامبر برسد، مرج اتفاق خواهد افتاد.

آیا این تاریخ دقیق است؟

بله، این تاریخ کاملاً دقیق است. در صورت تغییر شدید هش ریت اتریوم، برخی تغییرات جزئی قابل مشاهده است. ما فکر نمیکنیم این اتفاق در دو هفته پیش رو رخ بدهد.

آیا عواملی وجود دارد که ممکن است تاریخ انتقال به اثبات سهام را تغییر بدهند؟

بله، اگرچه این یک اتفاق بسیار بعید است، اما توسعه دهندگان اتریوم میتوانند مرج را به میزان بالاتری از سختی کلی ترمینال موکول بکنند و آن را به تعویق بی اندازند

مرج چگونه اتفاق میافتد؟

ما شایعات زیادی شنیدهایم مبنی بر اینکه استخراج اتر ((ETH پس از مرج همچنان امکانپذیر خواهد بود و فقط سختی استخراج آن به خاطر بمب سختی و غیره افزایش مییابد. اما اینطور نیست. هنگامی که مرج اتفاق میافتد، شبکه اتریوم دیگر بلوکهای استخراج شده توسط POW را قبول نمیکند. بنابراین فرآیند ماینینگ به کل منسوخ می شود

استخراج اتریوم (ETH) در اواسط ماه سپتامبر (تقریباً در 14 سپتامبر) متوقف میشود و دیگر استخراج ETH امکان پذیر نخواهد بود

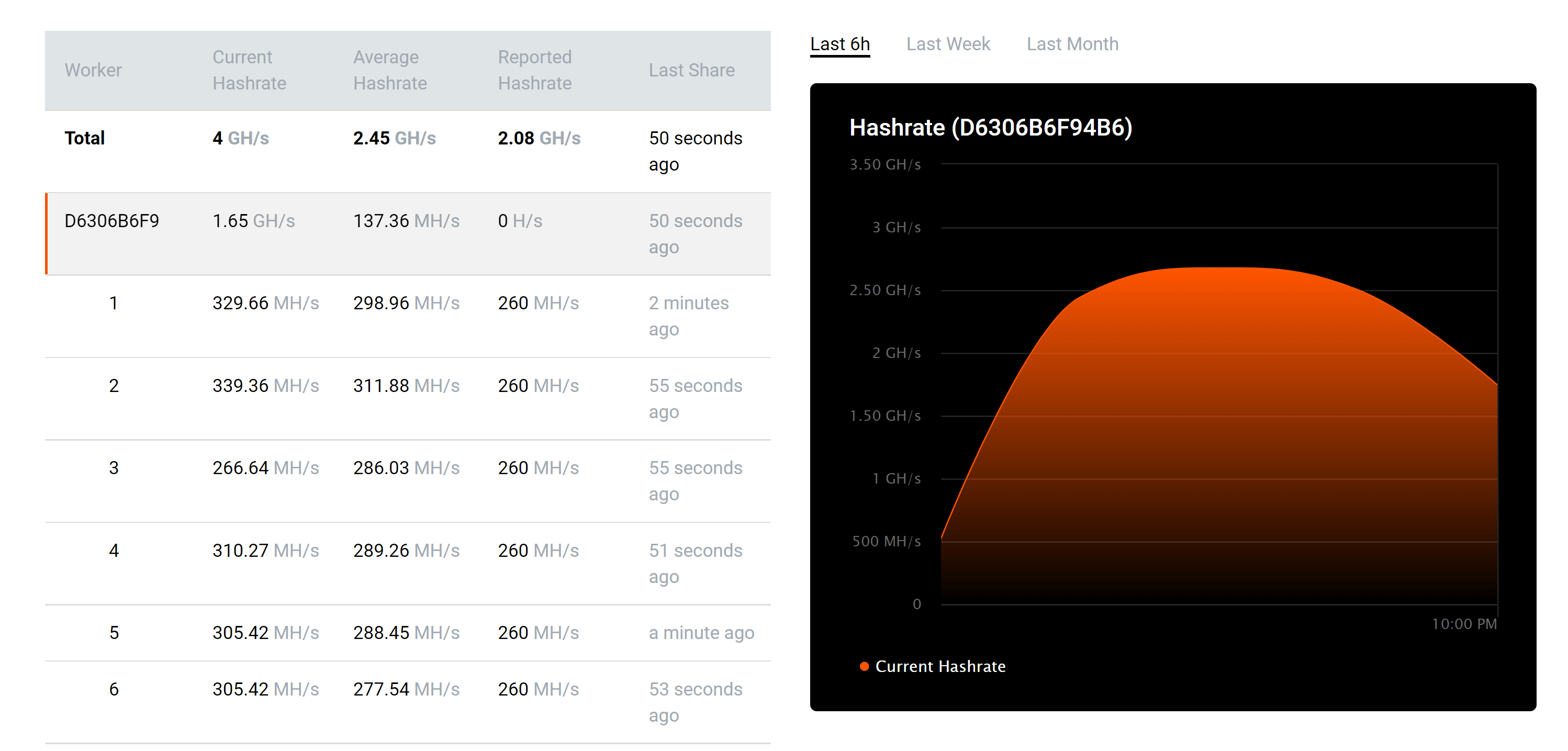

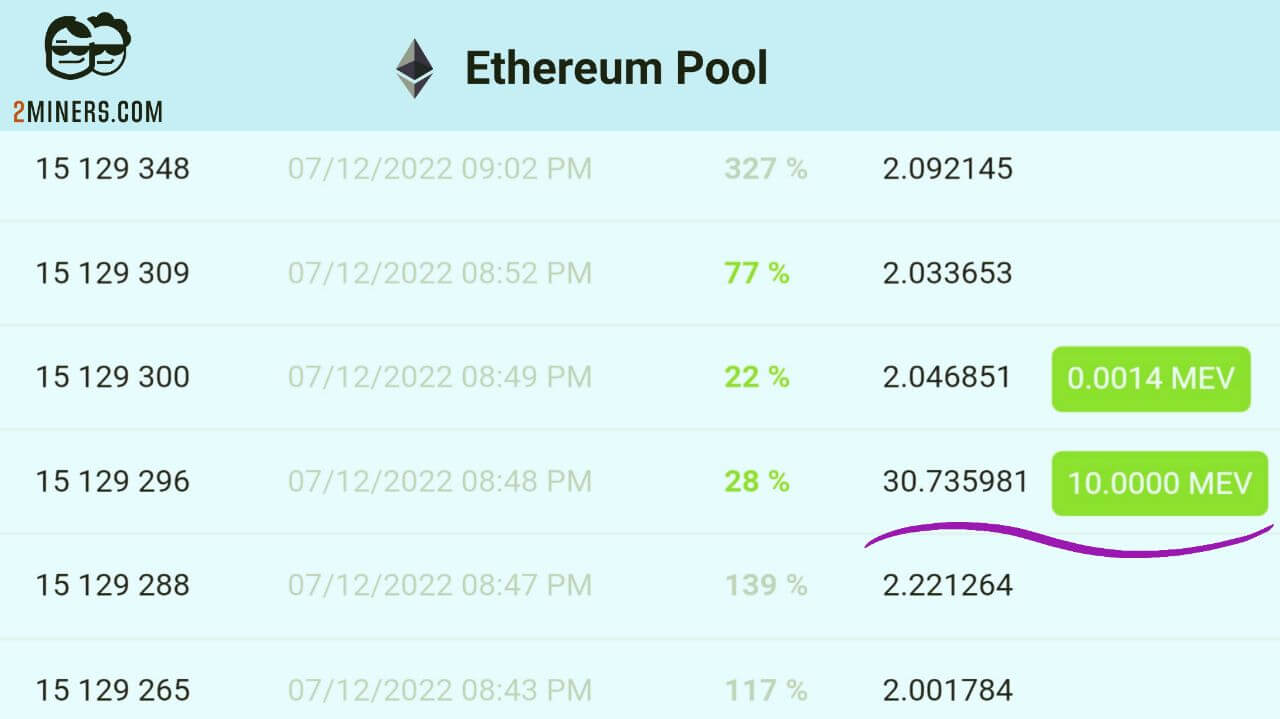

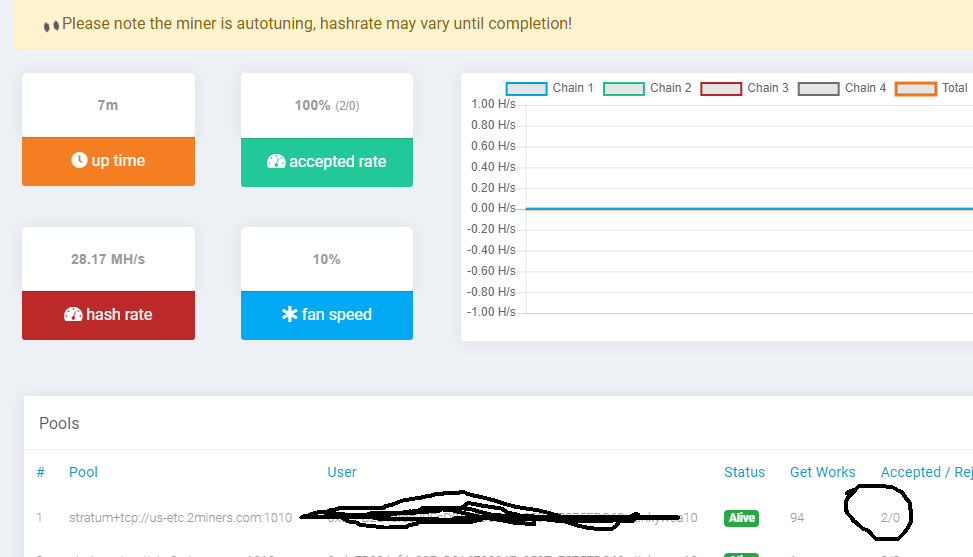

عملکرد استخر اتریوم 2Miners چگونه خواهد بود؟

در آن لحظه خاص که سختی کلی ترمینال اتریوم به مقدار از پیش تعیین شده 58,750,000,000,000,000,000,000 میرسد، این استخر دیگر نمیتواند بلوک ETH جدیدی پیدا کرده و پاداش دریافت کند. از طرفی تاریخ و زمان رویداد مرج دقیق نیست، بنابراین تا زمانی که مرج اجرا بشود این استخر به فعالیت خود ادامه خواهد داد

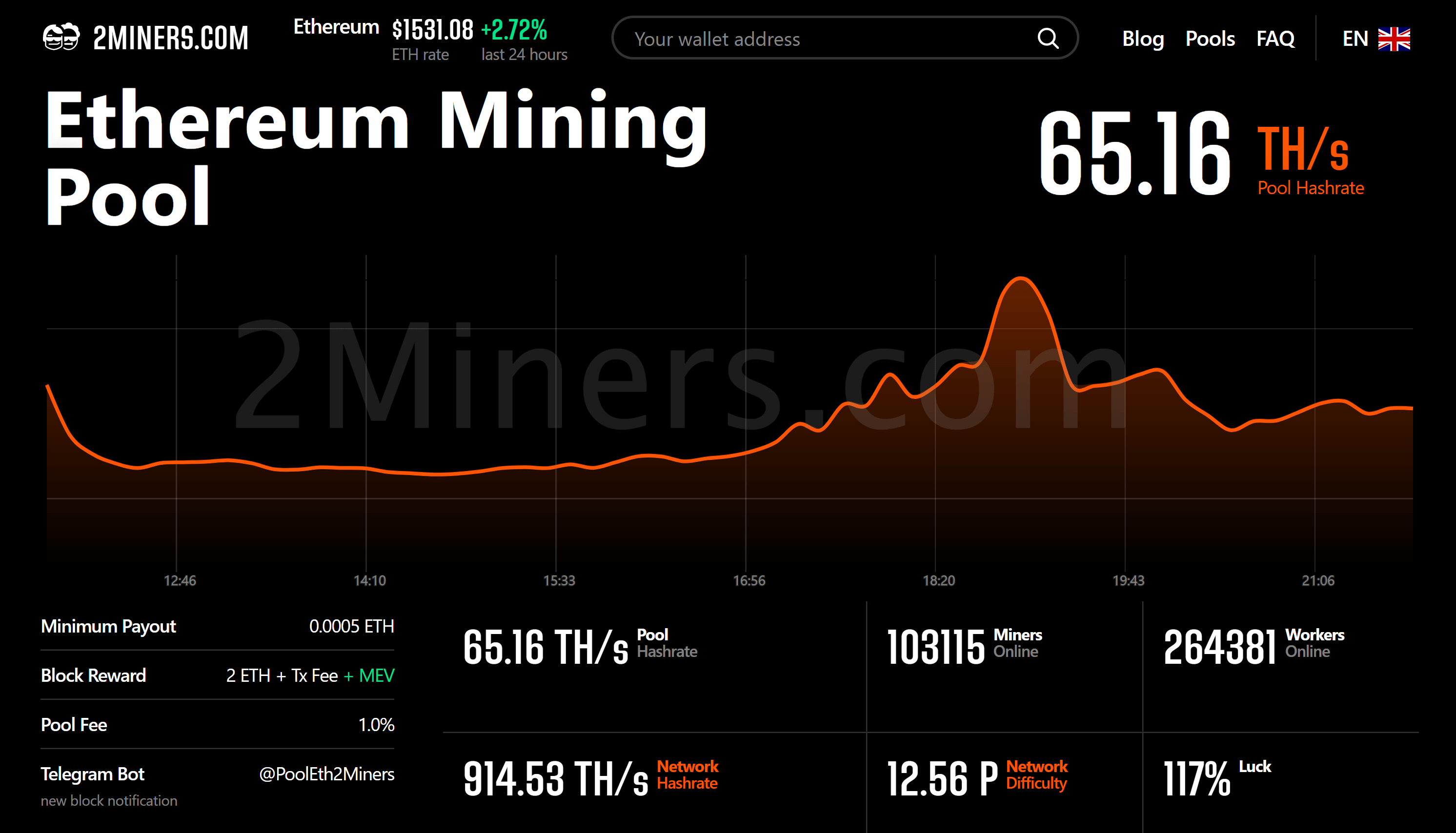

ما از داشتن چنین استخر و جامعه فوقالعادهای سپاسگزاریم. هم اکنون بیش از یکصد هزار ماینر در حال استخراج اتریوم در 2Miners هستند. میخواهیم یک تشکر بزرگ از شما بکنیم! به همه ماینرها؛ بدون تعارف، ما همیشه از ماینرهای خود دفاع میکنیم، و در این لحظه غم انگیز تا آخرین بلوک استخراج شده خواهیم جنگید

هنگامی که مرج اتفاق میافتد، استخر

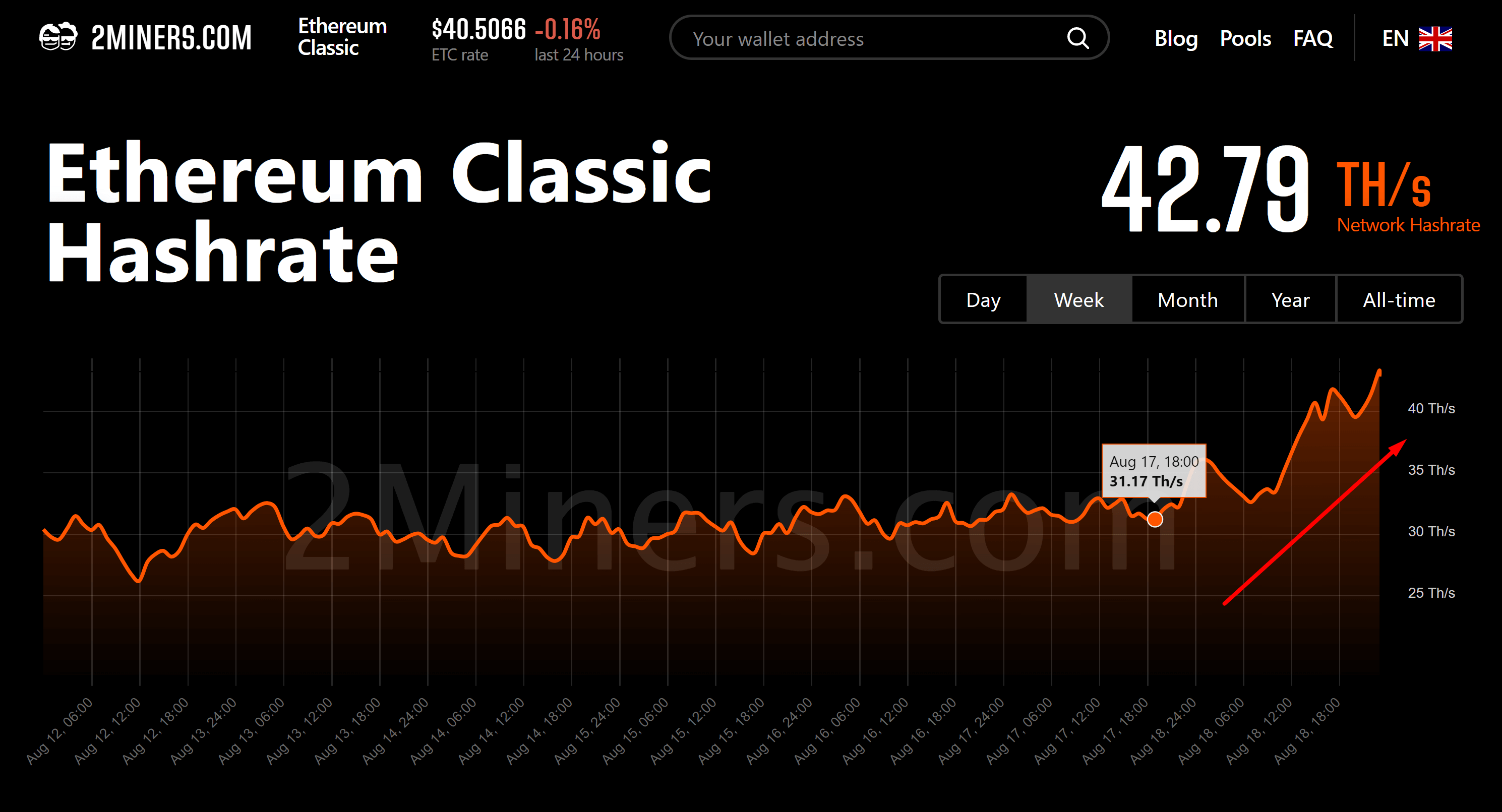

2Miners همچنان سهمهای استخراج را برای مدت کوتاهی میپذیرد. بدیهی است که هیچ پاداشی پس از رویداد مرج قابل دریافت نباشد. ما دوست داریم شما را بهطور خودکار به استخر استخراج اتریوم کلاسیک منتقل کنیم. با این حال، این امر غیرممکن است زیرا اتریوم کلاسیک از نسخه اصلاح شده الگوریتم استخراج Ethash به نام Etchash استفاده میکند. برای انجام این کار باید تنظیمات نرمافزار خود را تغییر دهید

پرداختهای استخر 2Miners

پرداختها تا زمان اجرای آپدیت مرج به روش استاندارد پردازش میشوند

پرداختها به آدرسهای اتر هر 2 ساعت یکبار پردازش میشود (در صورت عدم وجود صف طولانی، معمولاً بسیار سریعتر خواهند بود). پرداختها به آدرسهای بیت کوین و اتریوم نیز یک بار در روز در ساعت 12:00 UTC و 16:30 به افق تهران پردازش میشود

پس از بروزرسانی مرج، آخرین پرداخت را به تمام کاربران استخر اتریوم پردازش خواهیم کرد. این امر میبایست چند ساعت بعد از مرج اتفاق بیفتد. ممکن است به دلیل مشکلات احتمالی شبکه کمی تأخیر هم داشته باشد. از آنجا که پردازش اتر قبلاً با اجماع اثبات سهام اتفاق نیفتاده بود، هر اتفاقی ممکن است بیفتد. بسیاری از صرافیهای ارزهای دیجیتال ممکن است واریز و برداشت اتر را برای زمان مرج تعلیق کنند. ما از صرافی های کراکن و بایننس برای پردازش پرداخت با ارزهای بیت کوین یا نانو استفاده میکنیم. لطفاً توجه داشته باشید که آخرین پرداخت با ارزهای بیت کوین یا نانو ممکن است تا زمانی که هر کدام از این دو صرافی فعالیت خود را با اتریوم از سر بگیرد، به تعویق بیفت

شما نیازی به درخواست پرداخت نهایی یا تقاضای دستی ندارید. اگر آستانه پرداختتان خیلی بالا بود، نیازی به تغییر آن ندارید. ما تمام ماندهحسابهای پرداخت نشده را که بیشتر از آستانه حداقلی پرداخت استخر اتریوم هستند، پرداخت میکنیم. حداقل آستانه برداشت برای آدرس های مختلف که به کیف پول شما واریز گردد به شرح زیر است

- برای آدرس اتر به میزان 0.01 سکه اتر می باشد

- برای آدرس بیت کوین به میزان 0.005 سکه اتر می باشد

- برای آدرس نانو به میزان 0.0005 سکه اتر می باشد

پس از پایان استخراج اتریوم چه کار کنیم؟

چندین رمزارز وجود دارد که بعد از پایان استخراج اتریوم میتوانید آنها را استخراج کنید. ما یک مطلب داریم حول اینکه وقتی اتریوم به اثبات سهام میرود چه رمزارزهایی را استخراج کنیم

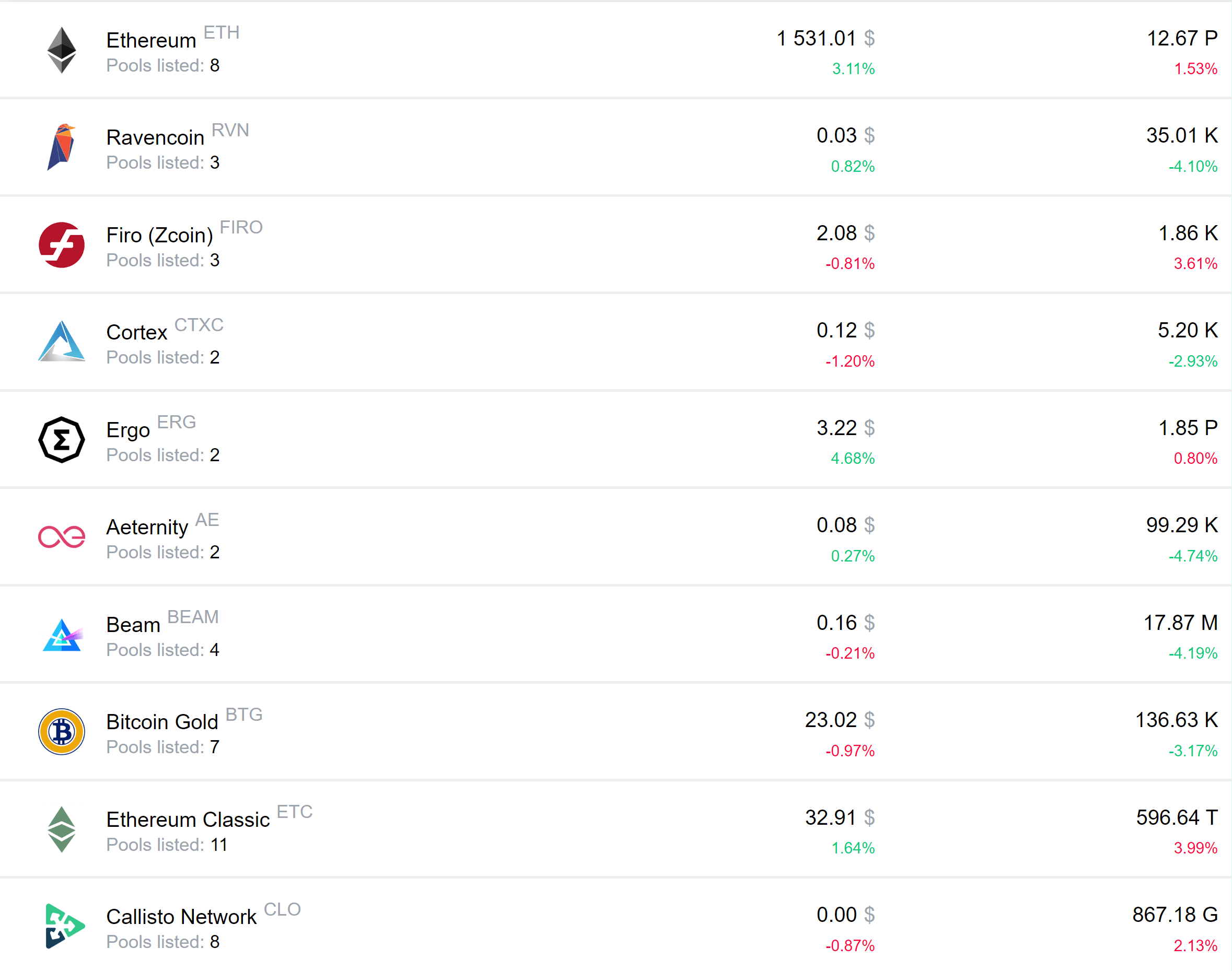

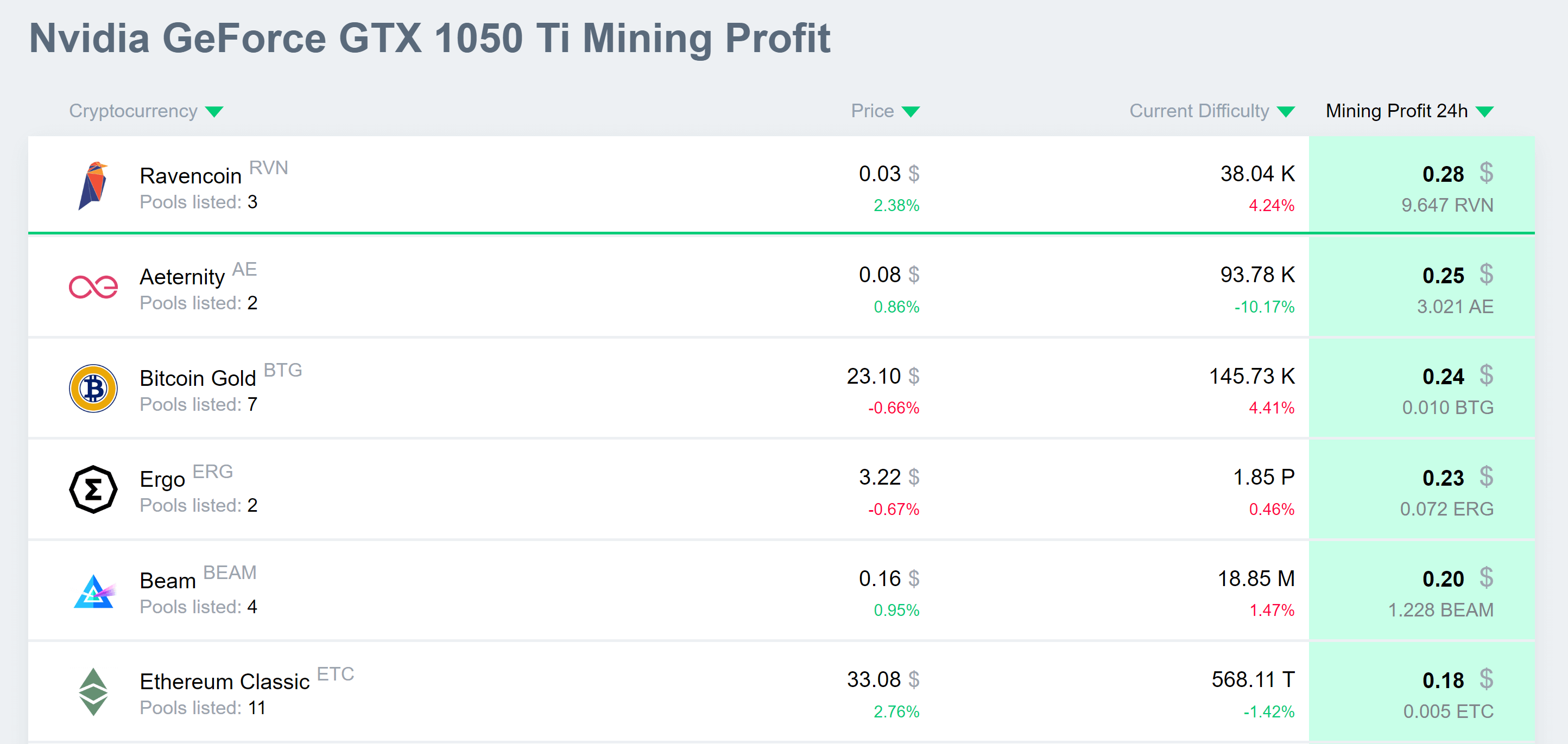

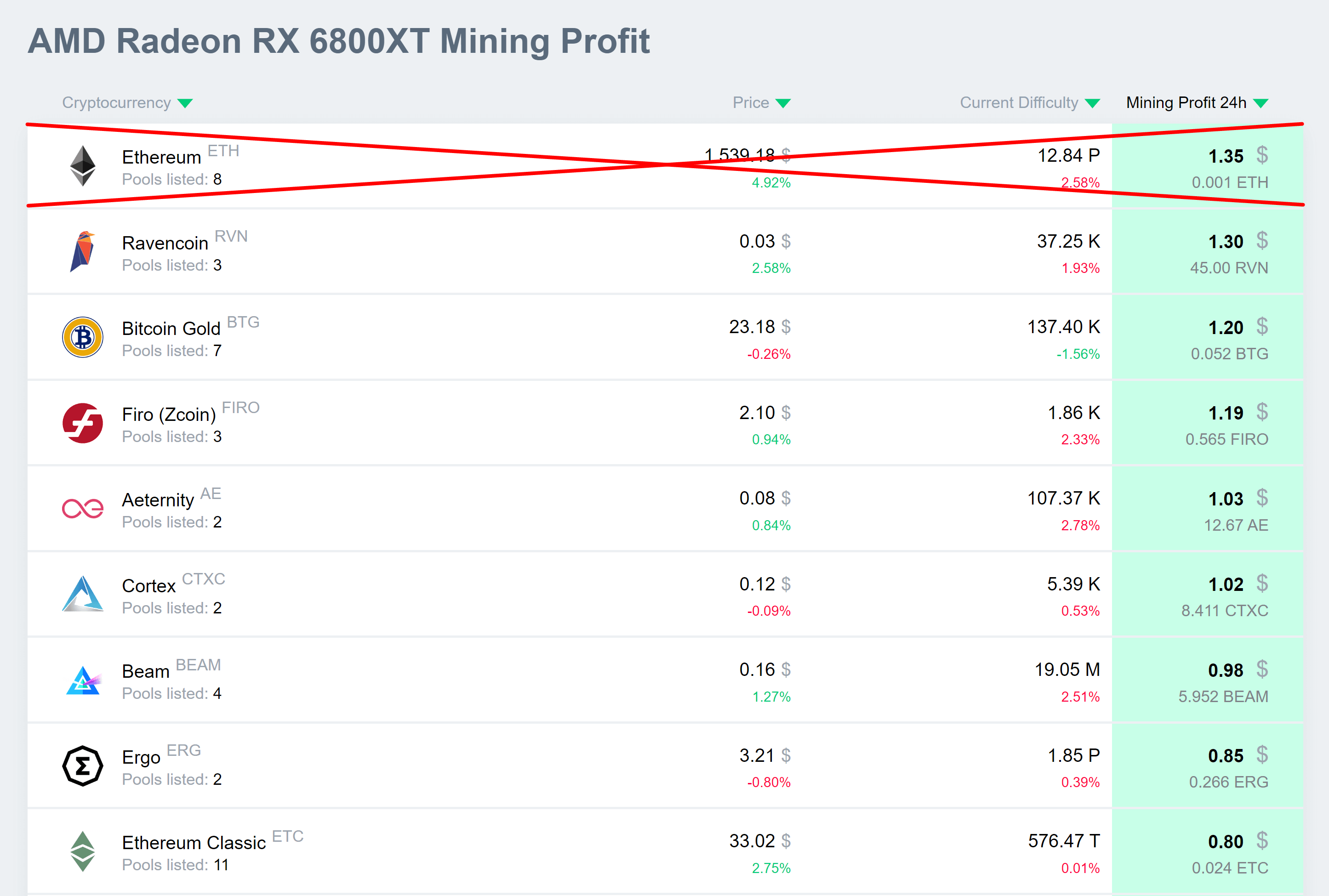

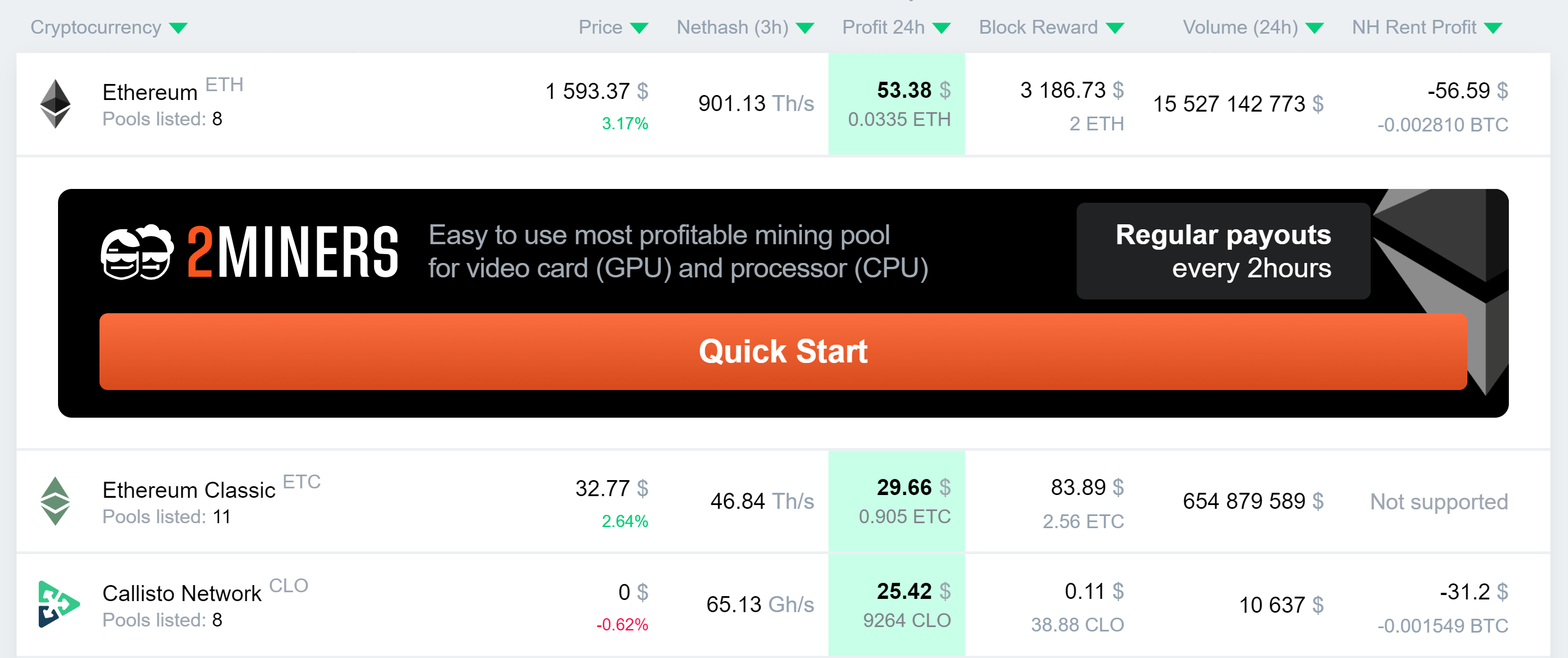

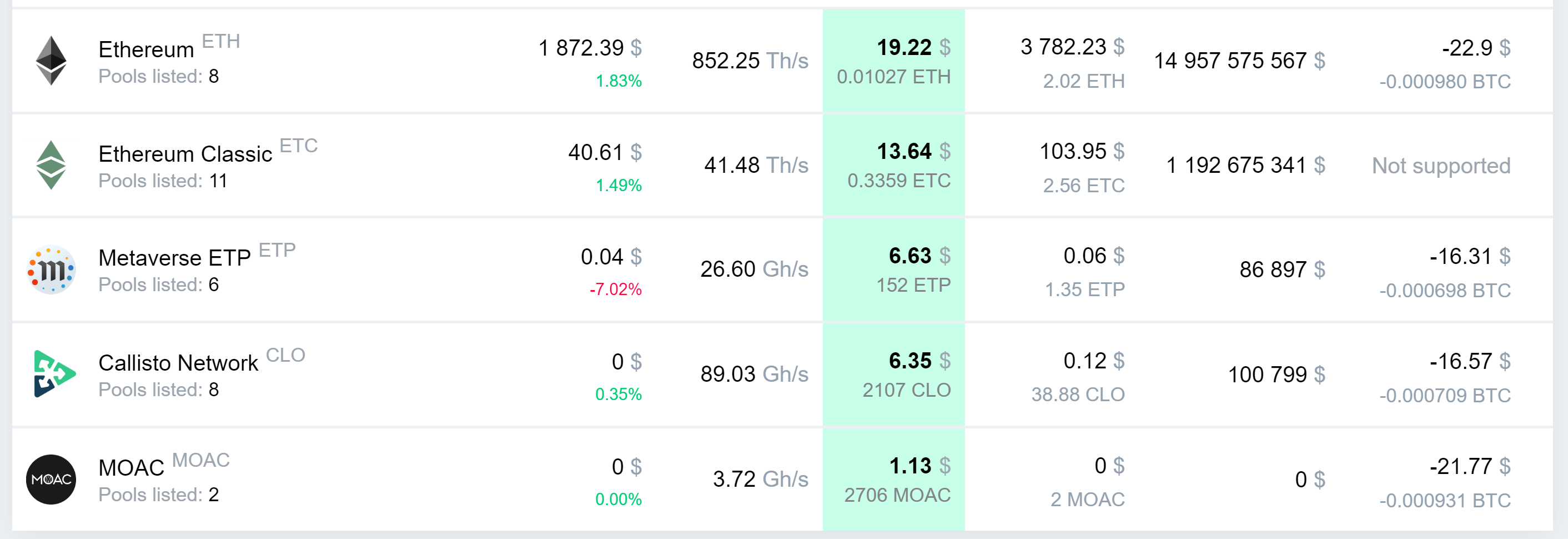

در حال حاضر سودآورترین توکنها بعد از اتریوم به شرح زیر هستند

Ravencoin, Firo, Cortex, Ergo, Aeternity, Beam, Bitcoin Gold, Ethereum Classic, Callisto. شما همیشه میتوانید سودآورترین توکنها برای سخت افزار خود را در ماشین حساب ما بررسی کنید

بدیهی است که وقتی استخراج اتر به پایان میرسد، قدرت هش عظیمی آزاد میشود. لذا محاسبات سودآوری توکن ممکن است برای مدت کوتاهی نادرست باشد. استخر 2Miners با ارائه تمام استخرهای استخراج آلتکوین در یک جا، بهترین تجربه ممکن را برای شما فراهم میکند. فقط وبسایت 2Miners.com را باز کنید، توکنی را انتخاب کنید که بیشترین سود را برای سخت افزار شما دارد، و سپس شروع به استخراج کنید

برخی از توکنها دارای هش ریت عظیم و برخی دیگر بسیار کوچک هستند. هیچ توکنی از نظر قدرت هش با اتریوم قابل مقایسه نیست، اما اتریوم کلاسیک (ETC)، ریون کوین (RVN) و ارگو (ERGO) نزدیکترین موارد به اتریوم هستند. انتخاب یکی از آنها ایمن ترین استراتژی پس از مرج است، حداقل برای روزهای اول

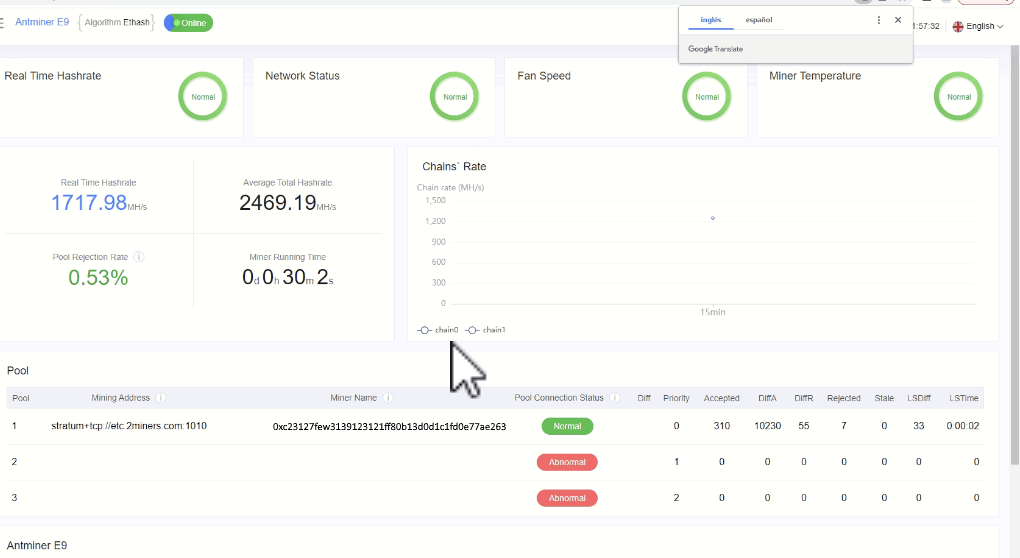

تغییر به استخراج اتریوم کلاسیک

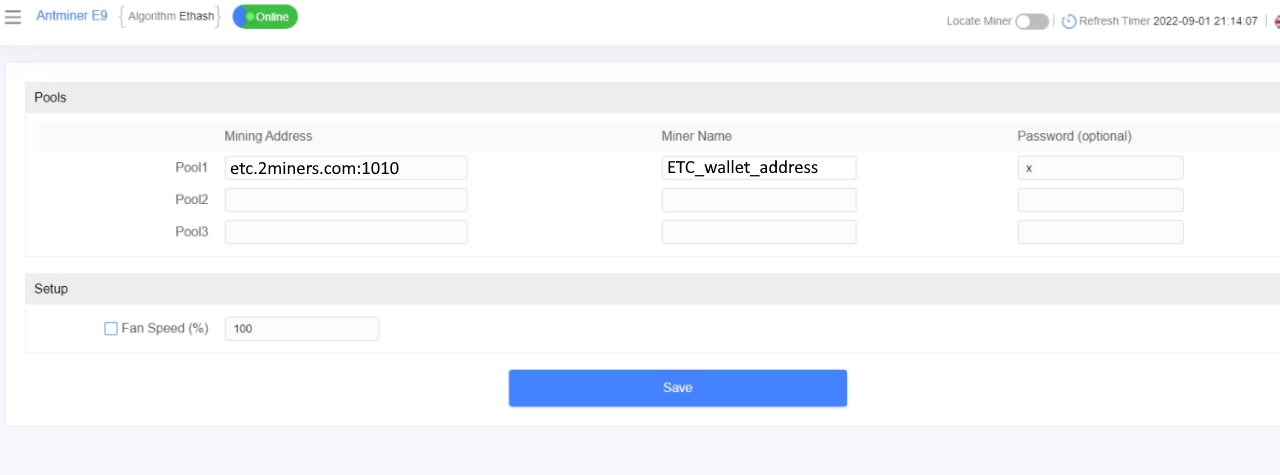

- هاست استخر را در نرمافزار ماینینگ خود از eth.2miners.com:2020 به etc.2miners.com:1010 تغییر دهید

- الگوریتم استخراج از ethash را به etchash تغییر دهید

اتریوم و اتریوم کلاسیک هر دو فرمت کیف پول یکسانی دارند. گاهی اوقات میتوانید آدرس کیف پول اتر خود را نگه کنید. تنها چیزی که نیاز دارید این است که به سادگی شبکه را از ETH به ETC در کیف پول خود تغییر دهید. گاهی اوقات این فرآیند سختتر میشود، مخصوصاً اگر کیف پول درون یک صرافی رمزارز را برای پرداخت دستمزد انتخاب بکنید. ما از پرداختهای بیت کوین برای استخر اتریوم کلاسیک نیز پشتیبانی میکنیم

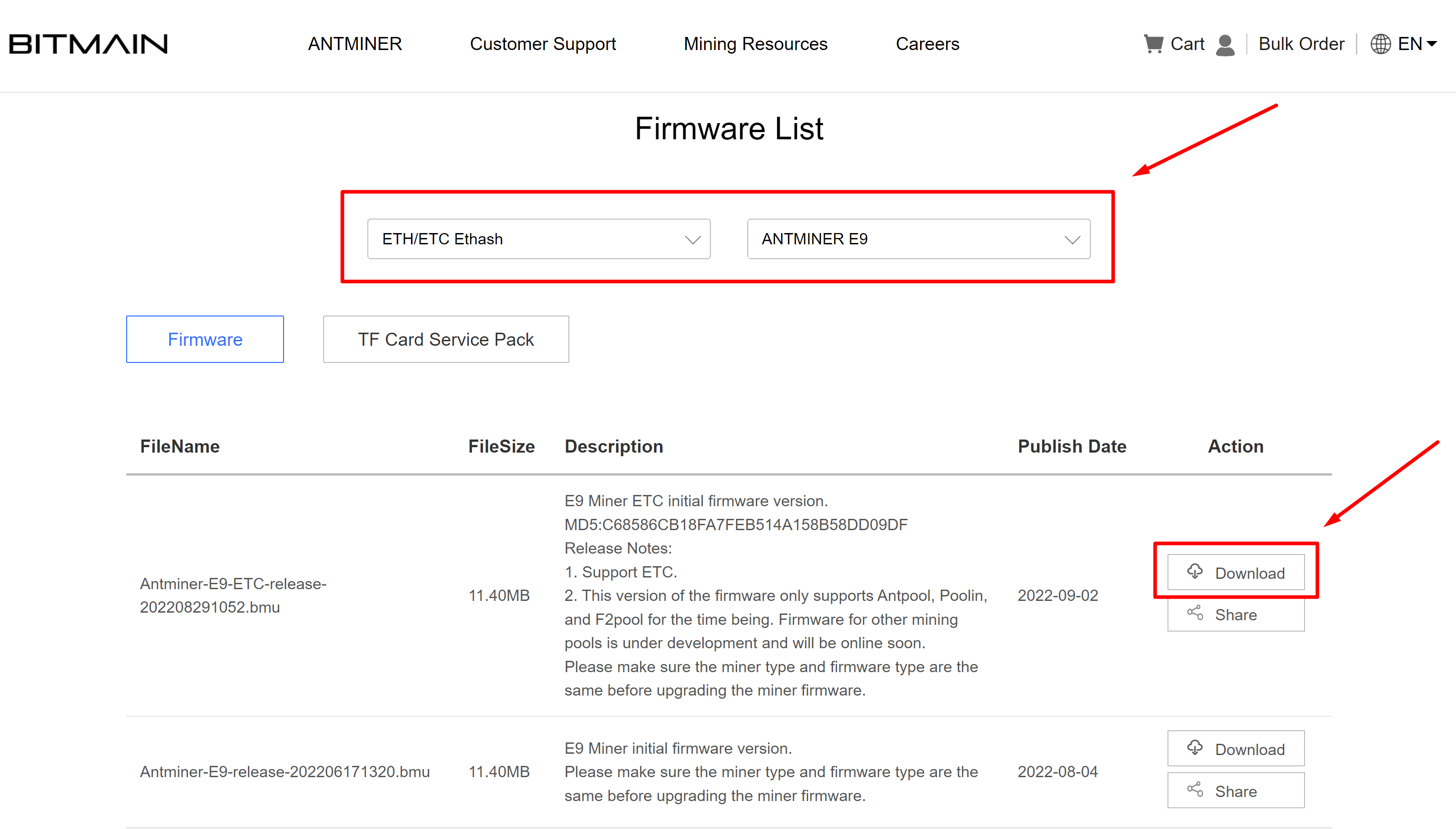

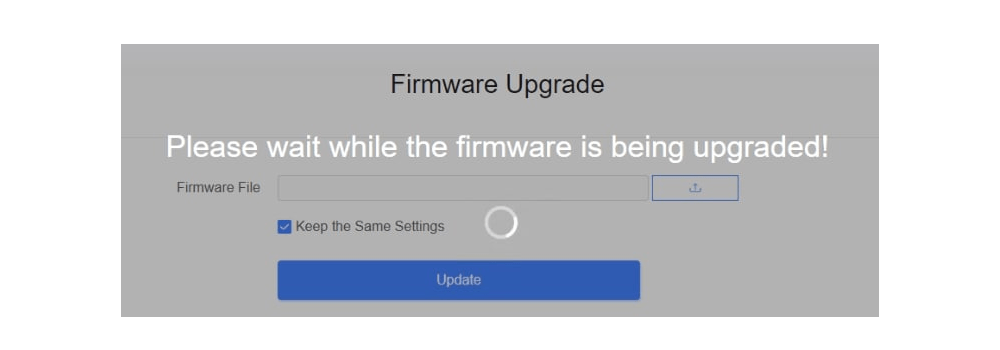

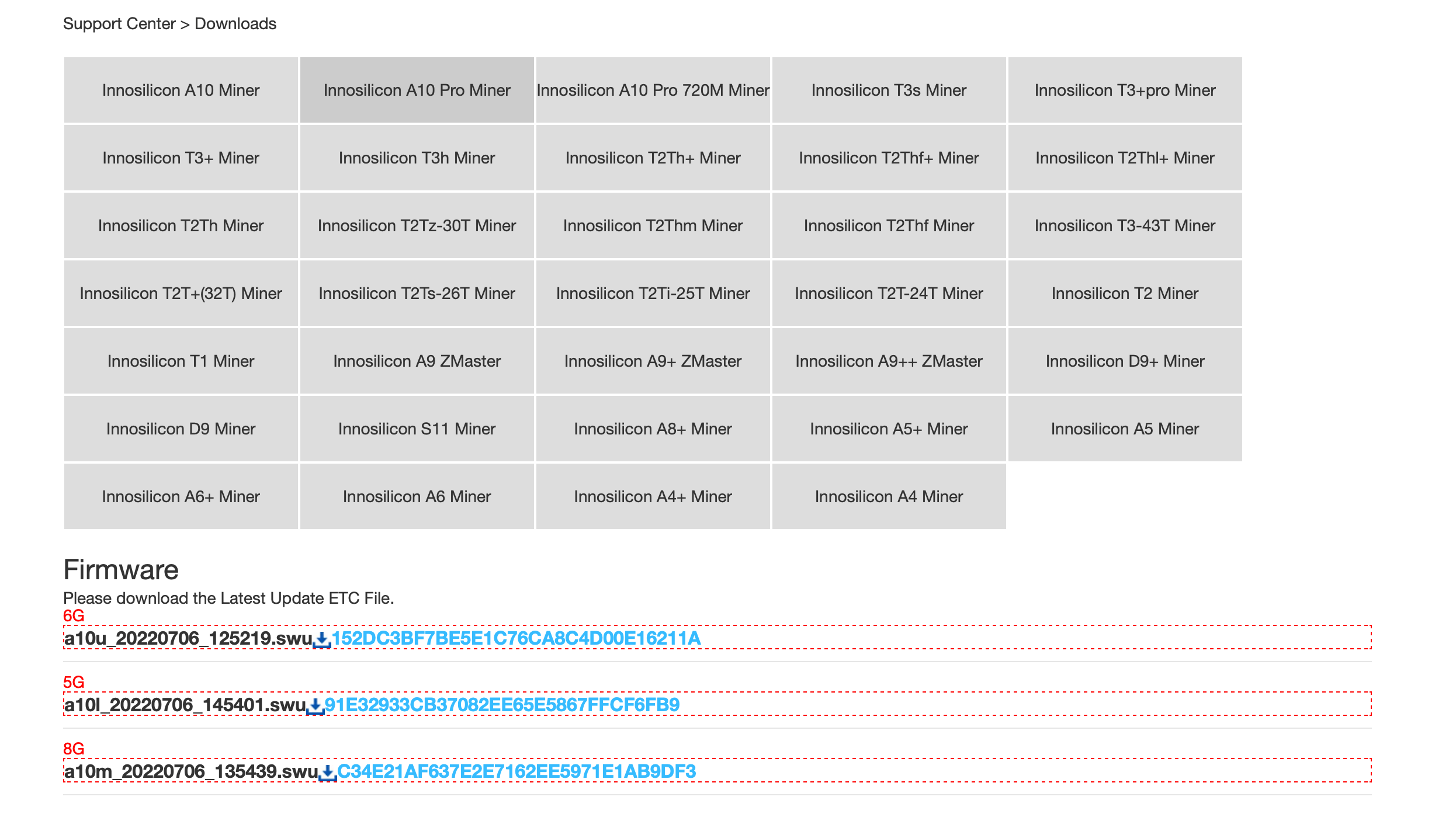

اگر از دستگاه اسیک استفاده میکنید، ممکن است به سیستم عامل جدیدی نیاز باشد. در اینجا یک مطلب دقیق در مورد تجهیزات تولیدی شرکت اینوسیلیکون ارائه شده است

URL: stratum+tcp://etc.2miners.com:1010

Worker: YOUR_ADDRESS.ASIC_ID

Password: x

بخش تنظیمات را میتوانید در etc.2miners.com/help پیدا کنید

همین امروز در تاریخ دوم سپتامبر 2022 یعنی یازده شهریور استخر Nicehash پشتیبانی از این رمزارز برای استخراج را آغاز کرده است

Custom pool name: 2Miners ETC

Algorithm: ETCHash

Stratum hostname or IP: etc.2miners.com

Port: 1010

Username: YOUR_WALLET_ADDRESS

Password: x

تغییر به استخراج ریون کوین

- هاست استخر را در نرمافزار ماینینگ خود از eth.2miners.com:2020 به rvn.2miners.com:6060 تغییر دهید

- الگوریتم استخراج را از ethash به kawpow تغییر دهید

- آدرس کیف پول خود را تغییر دهید. آدرسهای ETH و RVN متفاوت از یکدیگر هستند

تنظیمات را میتوانید در rvn.2miners.com/help پیدا کنید

استخر Nicehash از این رمزارز برای استخراج پشتیبانی می کند

Custom pool name: 2Miners RVN

Algorithm: KAWPOW

Stratum hostname or IP: rvn.2miners.com

Port: 6161

Username: YOUR_WALLET_ADDRESS

Password: x

استخراج اِرگو

- هاست استخر در نرمافزار ماینینگ خود را از eth.2miners.com:2020 به erg.2miners.com:8888 تغییر دهید

- الگوریتم استخراج از ethash به autolykos2 تغییر دهید

- آدرس کیف پول خود را تغییر دهید. آدرسهای ETH و ERG متفاوت هستند

پرداختهای بیت کوین هنوز برای ارگو پشتیبانی نمیشوند، اما توسعه دهندگان ما در تلاش هستند تا این قابلیت را در ماه سپتامبر پیاده سازی کنند

تنظیمات را میتوانید در erg.2miners.com/help پیدا کنید

استخر Nicehash از این رمزارز برای استخراج پشتیبانی می کند

Custom pool name: 2Miners ERG

Algorithm: Autolykos

Stratum hostname or IP: erg.2miners.com

Port: 8888

Username: YOUR_WALLET_ADDRESS

Password: x

استخراج EthereumPoW

اخیراً یک پروژه جدید به نام EthereumPoW با نام اختصارETHW به وجود آمده است. تیم توسعهدهنده آن میخواهد بدون تغییر به اثبات سهام، زنجیره اصلی اتریوم را حفظ کند. ما فکر میکنیم که امکان اینکه بتوانیم ماینرها را به راحتی از استخراج ETH به استخراج ETHW سوق بدیم وجود ندارد. شبکه ETHW مدتی پس از خود رویداد مرج شروع به کار خواهد کرد

در حال حاضر، ما در حال بحث در مورد امکان افزودن ETHW به استخر 2Miners هستیم و با توسعه دهندگان پروژه در تماس هستیم. همچنین با شروع استخراج ETHW ما شاخص محاسباتی EthereumPoW را به ماشین حساب 2Cryptocalc اضافه میکنیم

در سال 2023 چه ارزی را با کارت گرافیک استخراج کنیم؟

تغییر اتریوم به اثبات سهام بدون شک یکی از مهم ترین رویدادها در تاریخ استخراج ارزهای دیجیتال در تمام تاریخ است. توسعه دهندگان اتر از ابتدا این را برنامهریزی کرده بودند، اما اکثر افراد انتظار نداشتند این اتفاق در سال 2022 رخ بدهد. اتریوم همیشه مهم ترین محرک صنعت استخراج کارت گرافیک بود. سال بعد فرآیند استخراج با کارت گرافیک به آسانی دوران های قبل نخواهد بود. در سال 2023 توکنهایی که استخراج کنید باید توجیه اقتصادی داشته باشند. دیگر آن دوران که میتوانستید استخراج اتر را روی ریگ خود تنظیم کنید و آن را برای چند سال فراموش کنید، گذشته است. از این پس همیشه باید سودآوری استخراج را با در نظر گرفتن هزینه های عملیاتی خود، به ویژه مصرف انرژی، محاسبه کنید

در سال 2023 چه ارزی را با کارت های انویدیا استخراج کنیم؟

پردازندههای گرافیکی انویدیا همیشه بهترین قدرت عمل را از نظر استخراج ارائه میکنند. انویدیا میتواند تمام الگوریتمهای کارت های گرافیک موجود را به خوبی استخراج کند. میتوانیم به شما اطمینان دهیم که این مزیت این برند در مقایسه با AMD است

بسیاری از کارتهای قدیمی سطح پایین مانند Nvidia GeForce GTX 1050Ti وجود دارند که هنوز هم میتوانند با سودآوری تا 0.3 دلار در روز استخراج کنند

کارت گرافیک دارای مموری 4 گیگابایت تقریباً برای تمام توکنها از جمله ریون کوین کافی است. دگ فایل ریون کوین در حال حاضر 3.523 گیگابایت است. این بدان معناست که شما همچنان میتوانید RVN را با یک کارت 4 گیگابایتی استخراج کنید، اما فقط در صورتی که با سیستم عامل لینوکس کار کنید. استخراج ریون کوین با GTX 1050Ti در ویندوز کاملاً غیرممکن است.

البته، شما نمیتوانید چنین الگوریتمهایی مانند CuckooCortex را با یک کارت 4 گیگابایتی استخراج کنید. این الگوریتم توسط رمزارز کورتکس با نام اختصاری CTXC استفاده میشود و حداقل به کارت گرافیک 8 گیگابایتی نیاز دارد.

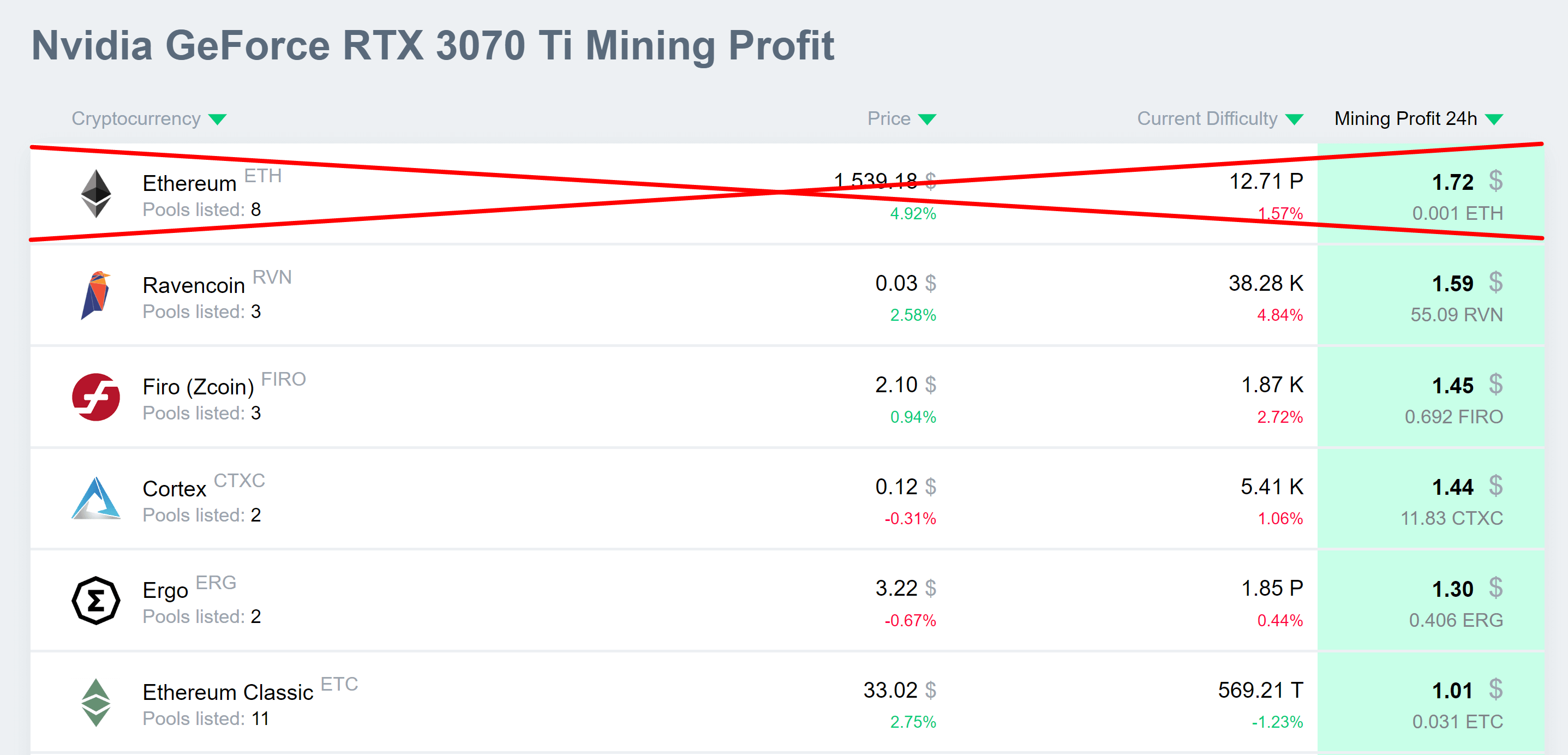

فرض کنید یک کارت انویدیا پیشرفته مانند Nvidia GeForce RTX 3070Ti دارید. چه کار باید بکنید؟

به ماشین حساب آنلاین ما به آدرس 2cryptocalc.com بروید و روی مدل کارت گرافیک خود کلیک کنید. بلافاصله جدول سودآوری ماینینگ را خواهید دید

بدون اتر هنوز هم توکنهایی وجود دارند که بیش از 1 دلار سود در روز برای شما به ارمغان می آورند. این جدول سودآوری زمانی تغییر میکند که اتریوم به اجماع اثبات سهام تبدیل شود و سودآوری روین کوین، اتریوم کلاسیک و سایر توکنها کاهش یابد. با این حال، اگر صاحب خوش شانس یک کارت گرافیک 3070Ti هستید، میتوانید توکنهای پرتقاضا مانند کورتکس را استخراج کنید. این رمزارز میتواند یک پناهگاه امن برای شما باشد.

در سال 2023 چه ارزی را با کارت های AMD استخراج کنیم؟

کارت های AMD اغلب ارزانتر از کارت های Nvidia هستند. همچنین معمولاً برق بیشتری مصرف میکنند و از الگوریتمهای استخراج کمتری پشتیبانی میکنند. هنگامی که اتریوم به اثبات سهام تغییر میکند، این عوامل میتوانند بسیار مهم باشند. به لطف نرم افزار مشهور lolMiner و دیگر توسعه دهندگان نرمافزار استخراج، کارت های AMD میتوانند توکنهای بیشتری استخراج کنند.

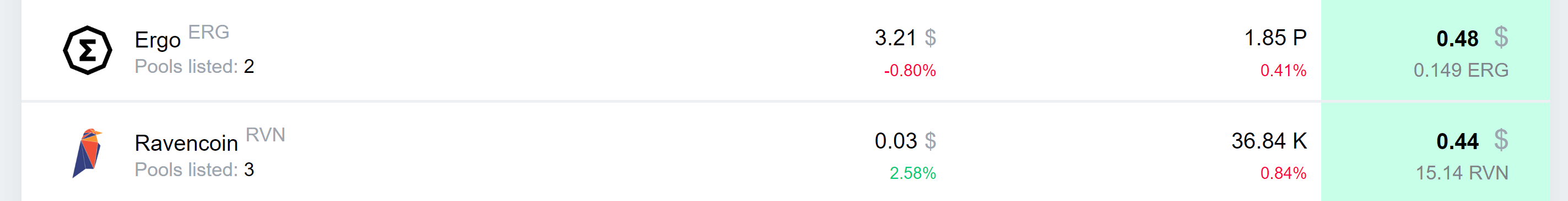

چنین کارت های دارای عمر پنج سالهای مانند AMD Radeon RX480 یا AMD Radeon RX580 حتی بدون اتریوم هم میتوانند با سود 0.5 دلار در روز استخراج کنند.

اگر حتی کارت گرافیک های 4 گیگابایتی دارید، همچنان میتوانید به استخراج در سال 2023 ادامه دهید. رمزارزهایی مثل ارگو، روین کوین، اتریوم کلاسیک و غیره. به نظر میرسد همه این توکنها برای سختافزار شما بسیار امیدوارکننده هستند.

“استخراج ریون کوین روی کارتهای گرافیکی 4 گیگابایتی تا اواسط سال 2023 امکانپذیر خواهد بود.

پس کارت های پیشرفته AMD چطور؟ اگر AMD Radeon RX 6800XT داشته باشید چه ارزی را می بایست استخراج کنید؟

روش آن مشابه Nvidia است. به ماشین حساب آنلاین ما به آدرس 2cryptocalc.com بروید و روی مدل کارت گرافیک خود کلیک کنید. بلافاصله جدول سودآوری ماینینگ را خواهید دید

در غیاب اتر اوضاع چندان بد به نظر نمیرسد. هنوز مشخص نیست که چگونه تغییر خواهد کرد. به هر حال، طولی نمیکشد و در پایان ماه سپتامبر، شاهد دنیای جدید استخراج ارزهای دیجیتال با کارت گرافیک خواهیم بود. ما شما را در بلاگ و توییتر خود به روز نگه خواهیم داشت

برای کسب اطلاعات بیشتر اکیداً به شما توصیه میکنیم به گروه ماینرهای فارسی زبان در تلگرام بپیوندید.