Ethereum 2.0 is a set of upgrades to the current Ethereum blockchain. First of all, it introduces Proof-of-Stake consensus: validators that stake ETH will replace GPU miners in creating blocks and ensuring the network security.

Eth2 also introduces sharding that will increase the cryptocurrency blockchain bandwidth 64 times. It means that it will be able to handle at least 64x more transactions per second and even more going forward.

The initial phase of transition to Eth2 known as Phase 0 started on December 1, 2020. That was when Ethereum launched its new network called Beacon Chain that activated the Proof-of-Stake mechanism.

Although PoS is more eco-friendly as it doesn’t require a lot of power, miners are not particularly happy about the new consensus algorithm. It will be much less profitable and it doesn’t need GPUs. After the merge of the current network Ethereum 1.0 with Beacon Chain miners will have to use their GPUs to mine other coins. How much less profitable is staking compared to mining?

To answer this question, we found out their profitability and compared them. We also talk about positive and negative aspects of Proof-of-Work and Proof-of-Stake.

Contents

Ethereum’s Staking Profitability

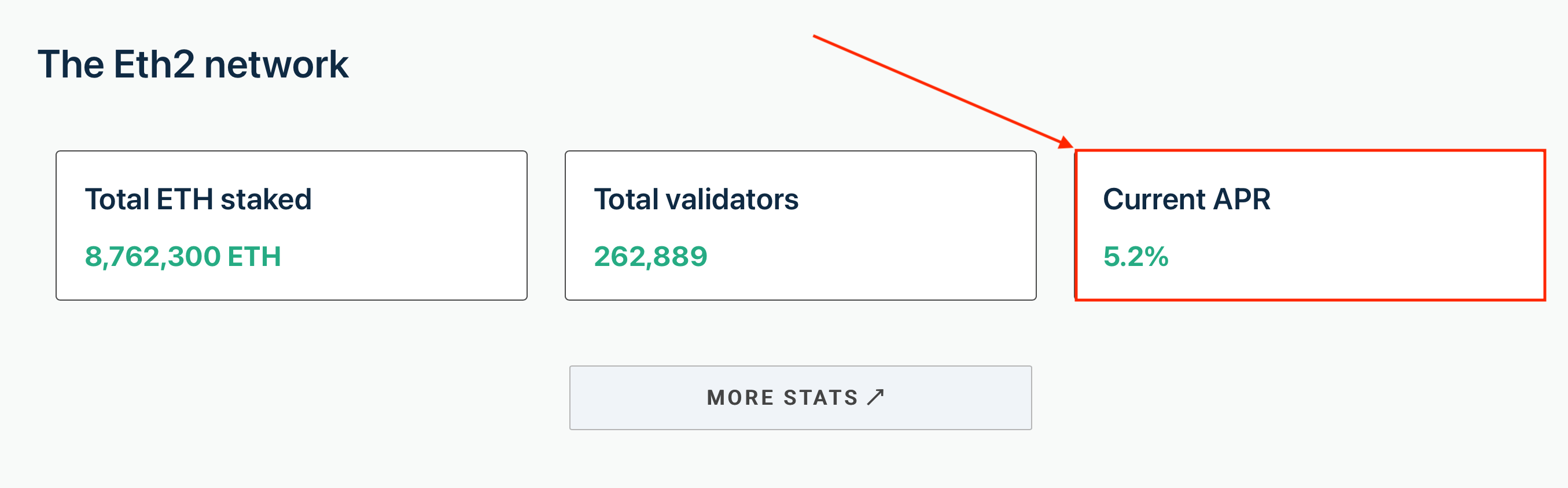

It’s quite easy to find out staking profitability in Ethereum 2.0: the Launchpad webpage displays up-to-date stats. It also contains guidelines for validators willing to help to secure the blockchain and earn rewards.

At the current amount of coins at stake, the annual percentage rate is 5.2%. So if you invest $100 thousand, in a year you will get $105.2 thousand, provided that the cryptocurrency rate remains stable.

There are two ways to stake Ether in the new network: directly or through special services. In the first case, you should have at least 32 ETH and be capable to launch a node. A network node is a piece of software that monitors what happens in the cryptocurrency network, votes for new blocks and gets rewards.

If you don’t have 32 ETH (after all, it’s more than $151 thousand), you can use services offered by special platforms. They gather coins from users and stake them. Then they distribute rewards according to provided shares and charge fees.

For example, Binance is one of the platforms that offer such services. The platform pays out rewards in the form of BETH tokens to Spot wallets.

Advantages of Ethereum’s PoS

Ethereum’s shift to Proof-of-Stake has its advantages. Thanks to PoS, the network can be protected without huge amounts of electricity needed to power GPU mining rigs. As a result, the environment will benefit from it.

For example, the energy consumption of Bitcoin miners is extremely high: it’s comparable to the energy consumption of a small country. With that being said, major industries like construction consume more energy and pollute the environment even more.

Those who live in countries with high electricity rates will appreciate it. Especially in Europe, where electricity rates have recently gone up. Overall, the cryptocurrency industry will benefit from it: just in spring Bitcoin was criticized because of excessive amounts of energy wasted on mining.

Another advantage is node maintenance. It’s much easier to maintain a node than a rig. Plus, if one of the rig parts breaks, it will take you a lot of time to detect the problem. But if you have a node, you just need to upgrade it to the latest version.

Disadvantages of ETH Proof-of-Stake

As we already mentioned above, you need 32 ETH for staking without intermediaries. At the current exchange rate, it’s quite a lot and not everyone can afford it.

But there is a solution. You can use third-party platforms that ask you to stake much less.

Ethereum staking has a big disadvantage: as of now, it’s impossible to redeem the initial deposit. The current Eth1 network is separate from Eth2, and the latter doesn’t offer withdrawal options. They will be added after the merge of the two networks, but it’s still unclear when. So best case scenario, you can expect to redeem your deposit in 6–12 months.

And last but not least, ETH staking in the PoS network brings low profits. 5% is not convincing at all in the crypto world.

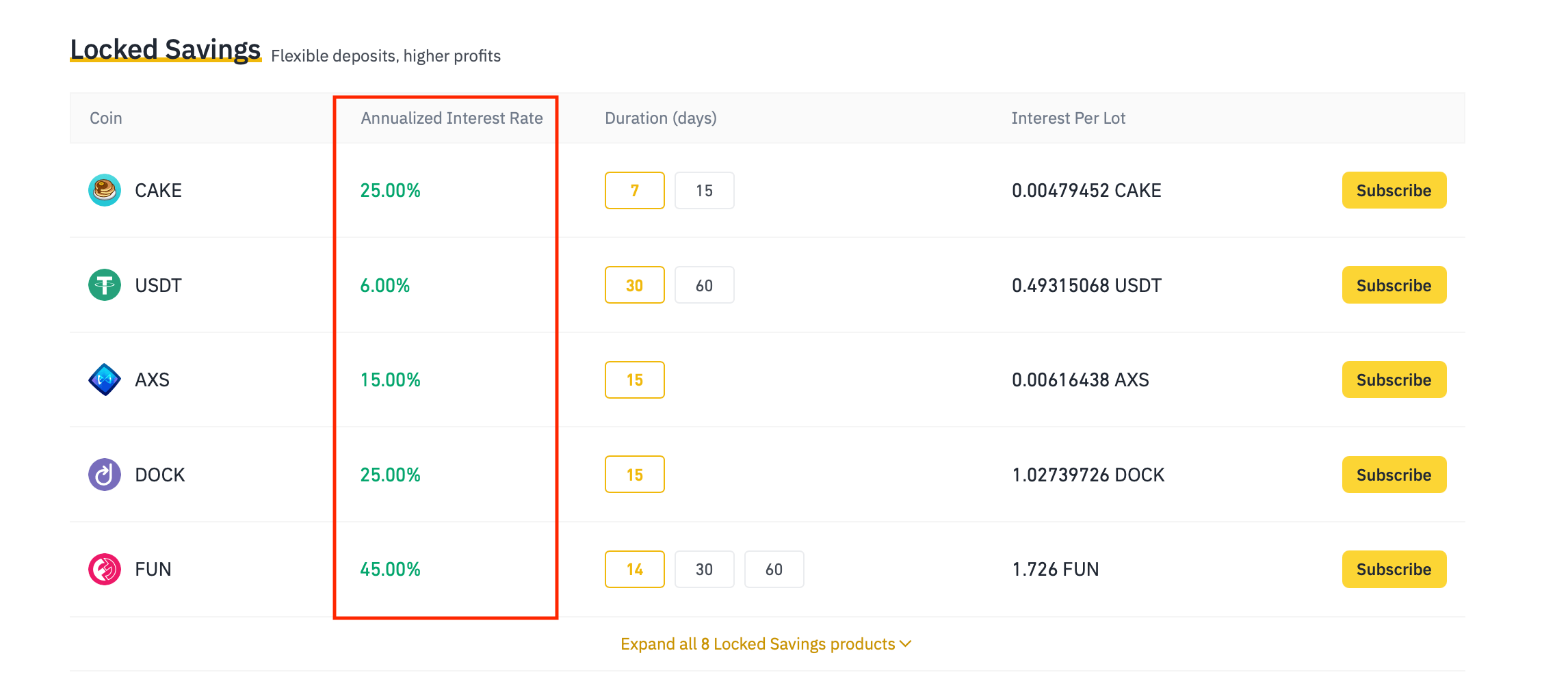

For example, Binance offers much higher interest rates on locked savings. And they also last for several weeks which would surely make investors happy.

What Can Cause Staking Profitability to Drop

Another important downside of staking is penalties. The first penalty was issued on December 3, 2020. Ironically, the validator didn’t mean to damage the network: he broke the rules out of ignorance.

We agree that network safety is crucial, but beginning validators may lose money just out of ignorance. And if you don’t upgrade your node in time, you might have even more serious problems.

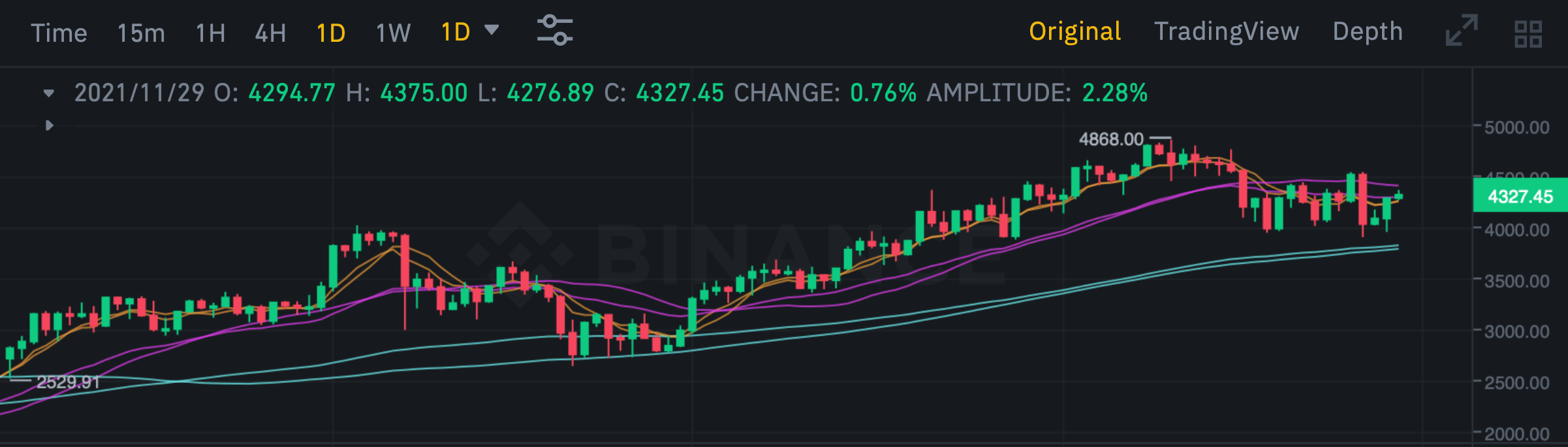

It’s important to note that staking profitability is bound to drop until it becomes possible to withdraw funds from the PoS network. So the only hope is that ETH rate in dollars will grow which is only possible if ETH increases in value.

Ethereum’s PoW Mining Profitability

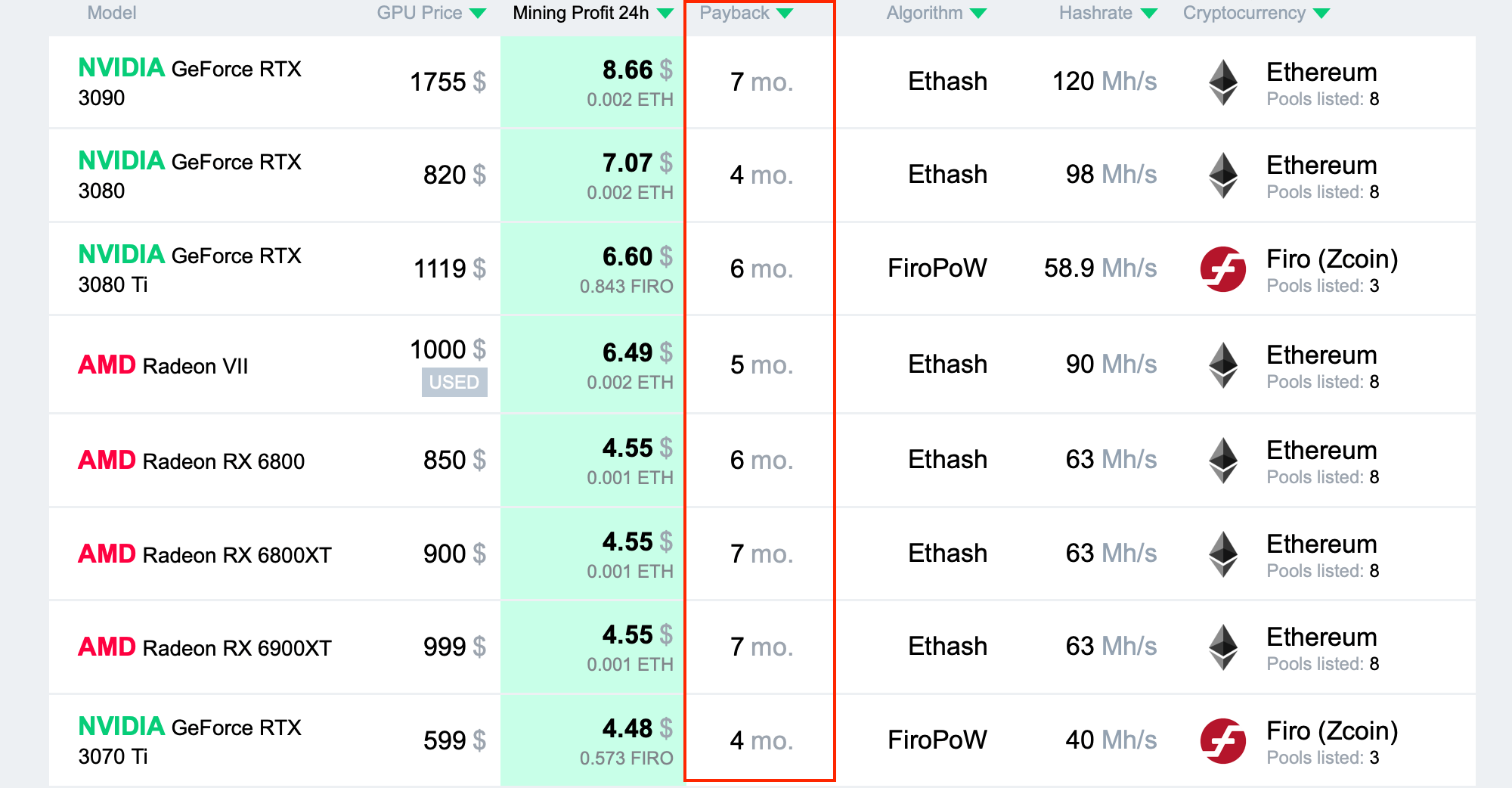

2CryptoCalc helps to calculate PoW mining profitability and payback. 2CryptoCalc calculates profitability of one GPU of various models and for various periods of time. It can also share links to download mining programs along with their settings.

For example, here is a page with different GPUs and their payback. You can even enter the price at which a device is sold in your area to get even more precise results.

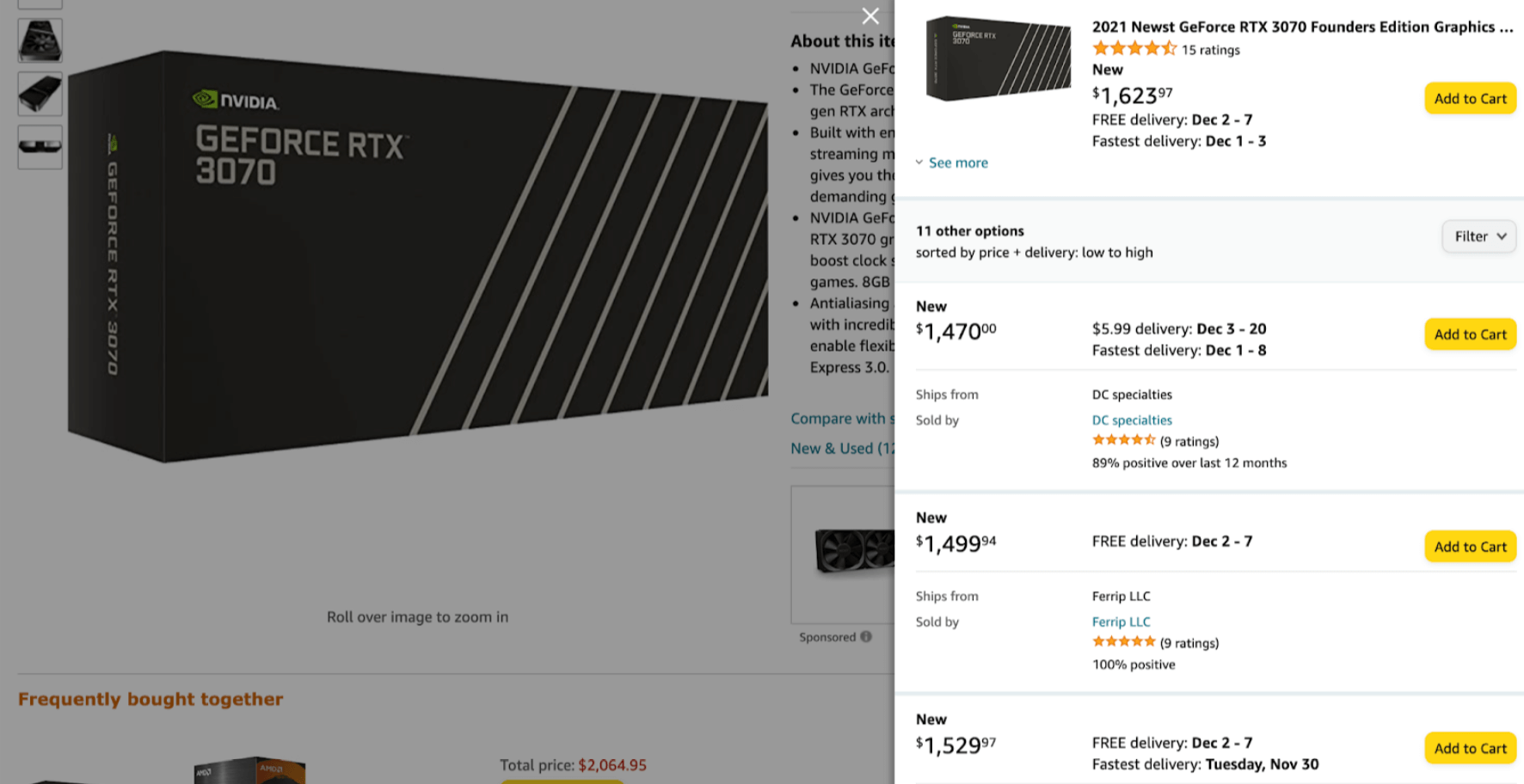

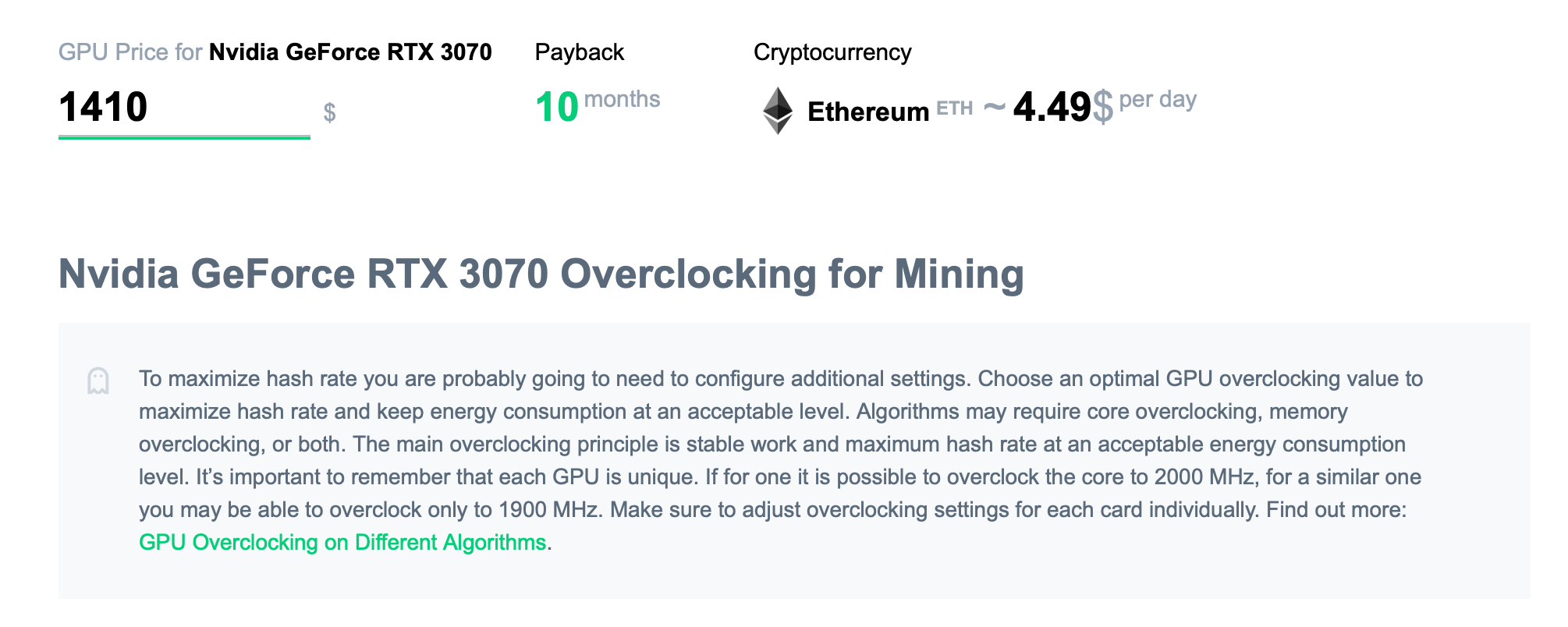

Let’s take Nvidia RTX 3070 as an example. The initial price was $580, but you can’t find it at such a price nowadays. Today you can find this model on Amazon at about $1,470.

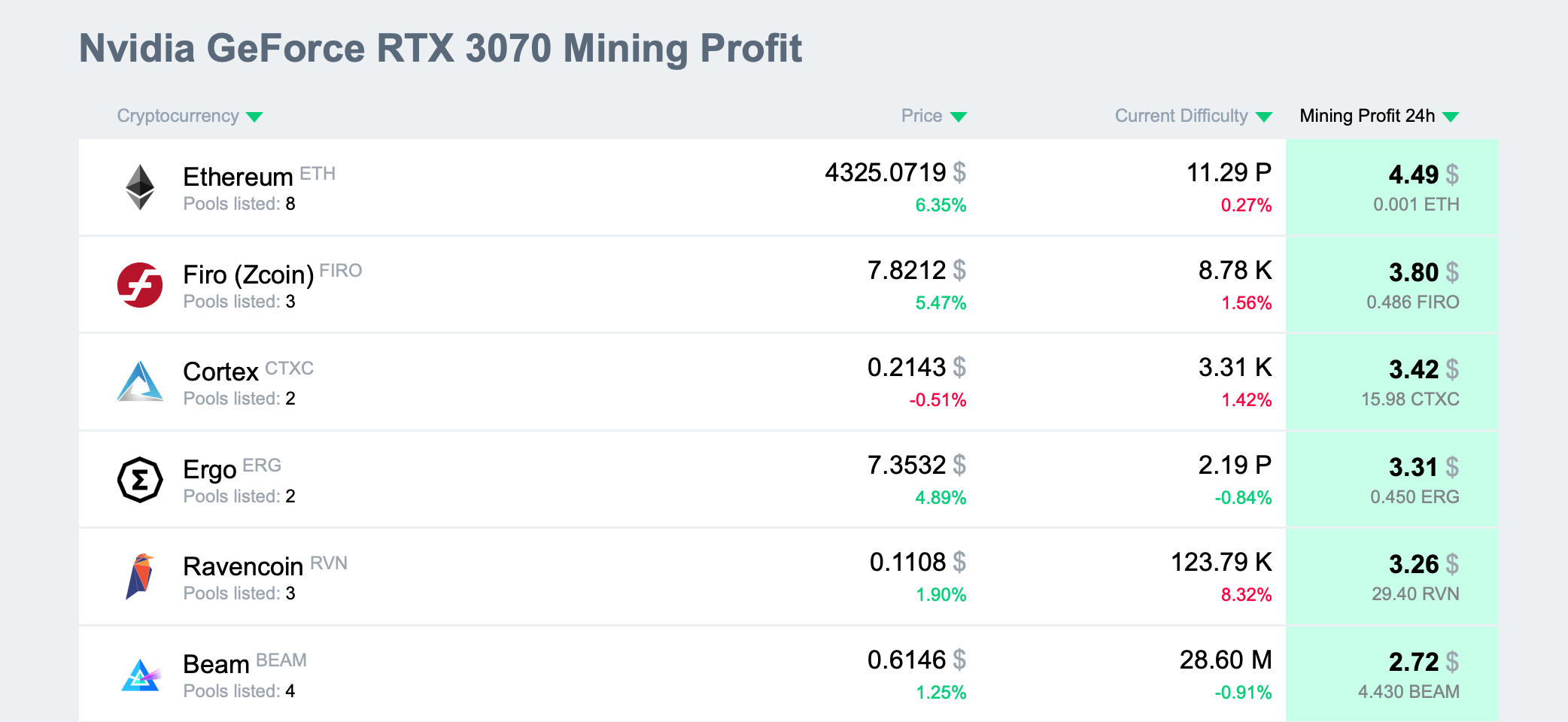

Ethereum is the most profitable coin for RTX 3070, like for many other graphics cards.

After we enter the price, you can see that the payback period is no less than 10 months.

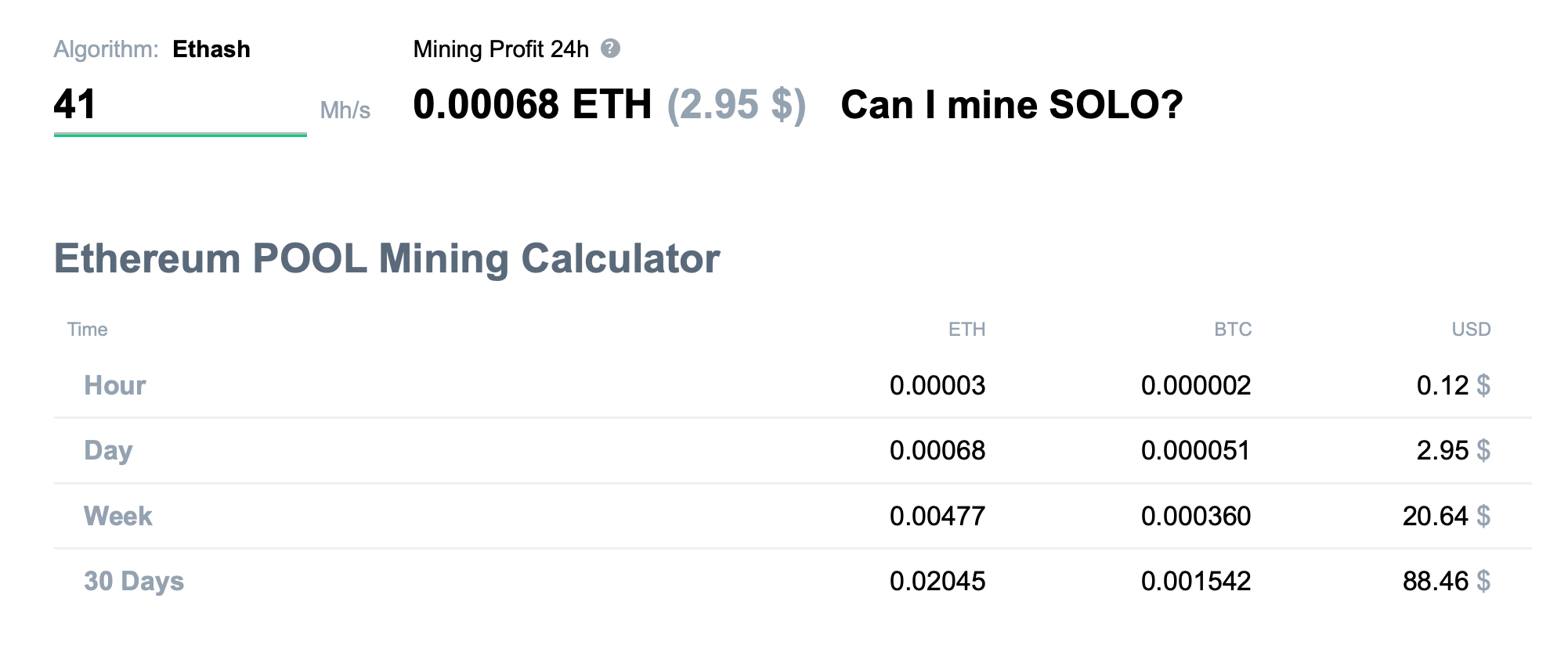

The graphics card can bring about $88.46 in one month and $1,061 in a year. This is about 72% of the initial investment which is almost 14x more profitable than PoS.

It’s important to note that you can get even better results. You should just spend more time on finding a used graphics card. It is cheaper than the new one, which means that the payback period will be shorter and profitability will be higher.

Say, you decided to mine on a larger scale and purchase eight graphics cards to build a rig. According to our article about building an Ethereum mining rig, it costs around $600. Let’s allow for an increase in prices and assume that today it costs $700 to build a rig.

You will need $11,760 to buy eight RTX 3070 cards. Considering the cost of a rig, we need about $12,500.

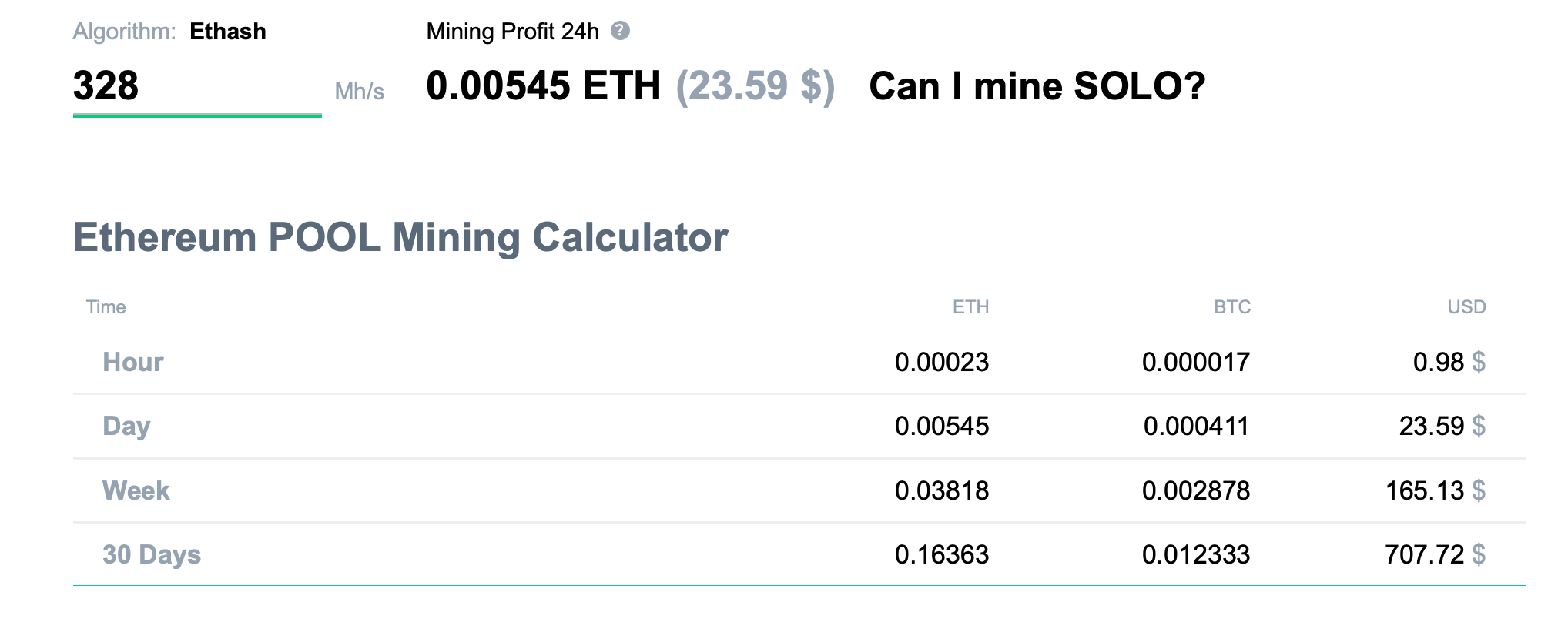

Now let’s calculate profitability. Each GPU gives out a hash rate of 41 Mh/s consuming 125 W. It’s 328 Mh/s in total which will bring about $26 a day.

Let’s not forget about expenses on electricity. A rig consumes about 1200 W. If an electricity rate is $0.07 per kWh, we get about $2.00 per day. So the net profit is $24.

The payback period is about 520 days ($12,500 [expenses] / $24 [daily profitability]), which is approximately one year and five months. Profitability in this case is 67%, as the yearly profit is about $8,484.

We used an average electricity cost. It can be lower or higher. The less you spend, the shorter your payback period and the higher your profitability.

It’s important to note that even though a rig doesn’t pay off in a year, GPU mining profitability is still much higher than that of staking. In the example above we got 73% of the initial investment in one year earning almost $8,500. You can also sell your devices anytime thus getting a surplus.

If Ethereum’s exchange rate increases, you will get your initial investment back even sooner.

Advantages of Ethereum’s PoW Mining

Ethereum’s PoW Mining on GPUs has a huge advantage over staking in terms of profitability. Some GPUs, especially used ones, can be paid off in a few months, after which you will start getting a surplus.

Plus, graphics cards are universal: you can use them to mine different cryptocurrencies. It is especially useful in the case of new projects with low mining difficulty and moderate exchange rates.

Considering the lack of devices today, graphics cards are also easy to sell. You can even make money from selling.

Disadvantages of PoW Cryptocurrency Mining

As we already mentioned above, it’s problematic to buy graphics cards nowadays. They are hard to get, and even if you find one, it will be hugely overpriced. But it doesn’t seem to stop miners: the payback period is still quite acceptable. Because of a rising demand manufacturers overprice devices even more.

One of the disadvantages of Ethereum mining on GPUs is the maintenance of devices. Even if devices operate well, you still need to fine-tune overclocking parameters, rates, etc., when mining software gets an upgrade. This takes a lot of time.

One of the most obvious downsides of PoW mining is the need for a physical location for devices. You need to keep them somewhere, ideally in the guarded area. And don’t forget about cooling and maintenance. You should also know how to set up your devices and how they operate.

Comparing PoS and PoW in Ethereum. Conclusion

PoW mining has an obvious advantage over staking in terms of profitability. Graphics cards can be paid off in about a year, which is an excellent result for any business. Considering the current market situation, it is likely to remain this way.

As a result, mining with one or several GPUs brings about 70% of return on investment as opposed to 5% of annual percentage rate for staking. It is clear that graphics cards are highly valued nowadays, so it makes a lot of sense to start mining Ethereum or other coins. We recommend mining in the 2Miners pool.

The main advantage is that you can always switch graphics cards between different cryptocurrencies or sell them. Plus, a lot of miners bought their mining equipment and paid it off long ago. So if you dedicate enough time to it, cryptocurrency mining can and will bring you money.

Join our Telegram community and remember to follow us on Twitter to get all the news as soon as possible.